A Bitcoin Maximalist’s Ode To Ordinals

This is an opinion editorial by L. Asher Corson, a partner at UTXO Management.

As a Bitcoin Maximalist, I love Ordinals. Other Maximalists should also consider loving Ordinals, as they demonstrate Bitcoin’s superiority in ways not previously possible. Ordinals enable functionalities that undermine the need for other blockchains to even exist. The use cases that were demonstrated on other blockchains are now possible natively on Bitcoin. Despite Bitcoin’s strengthening position, some self-proclaimed Maximalists on X (formerly Twitter) bizarrely celebrated decreased network fees and declared Ordinals to have failed. This seemingly implies that Bitcoin might somehow benefit from a failure of the Ordinals protocol and lower miner earnings. But Ordinals haven’t failed and the interest isn’t nearly over. To the contrary, trading volume across digital artifacts, unique satoshis and BRC-20 tokens has been historic. According to cryptoslam which tracks on-chain NFT volume, Ordinals have done over $500 million of trading volume since they were launched at the beginning of 2023. Despite volume and prices being down currently, investors in the ecosystem are writing big checks to Ordinals companies. Xverse, an Ordinals wallet, just raised 5 million dollars on a 50 million dollar valuation from some of the most sophisticated investors in the ecosystem. It’s far more likely we are at the beginning of this phenomenon than the end.

What are Ordinals? It is a protocol developed by Casey Rodarmor (@rodarmor) that enables any data to be included in a Bitcoin transaction. It uses Ordinal Theory to associate that data with a specific satoshi (the smallest unit of Bitcoin) which can be owned and traded. This innovation enables the creation and trading of digital assets directly on the Bitcoin blockchain without a peg or a bridge.

Bitcoin Maximalists understand that there have never been serious contenders to replace bitcoin as digital money, and it’s unlikely any will ever emerge. Viable altcoin use cases have never been based on having better monetary properties than bitcoin because that really isn’t possible. Absolute digital scarcity is unlikely to be discovered again because the circumstances surrounding Bitcoin’s creation were so unique, in part, because today’s government understands the risks of letting a decentralized network grow too large and they won’t let it happen again.

On the other hand, viable altcoin use cases are related to features that Bitcoin couldn’t previously support. Some of those use cases that the market has indisputably embraced include: decentralized trading, non-fungible tokens (NFTs), stablecoins, capital formation, borrowing/lending and on-chain leverage. Uniswap, a decentralized exchange, has done almost $500 billion in trading volume since it was launched in 2018. Additionally, Ethereum has done $43.6 billion in NFT trading volume, according to CryptoSlam!. Source: CryptoSlam! NFT data, rankings, prices, sales volume charts, market cap

Although many don’t like it, these use cases will exist somewhere because the market has an appetite for them. My strong preference is that they exist primarily on Bitcoin and not on other chains. It would certainly be better for Bitcoin and the effort to separate money and state, if there were not so many competing chains soaking up market share. Ordinals have the potential to not only enable these use cases to be built natively on Bitcoin, but also to surpass their altcoin versions in terms of implementation. These would be better built on Bitcoin because the protocol itself is more decentralized and secure than altcoins. Bitcoin has the largest market capitalization compared to all the other chains that can support the development of these use cases. But also better because these use cases will be tailored to the Bitcoin community and will therefore embody Bitcoin ideals of decentralization, immutability and permissionlessness.

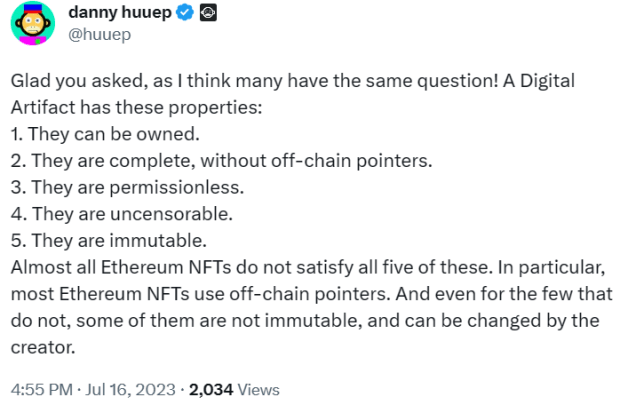

Although the protocol itself can’t stop scams, Rodarmor purposefully built Ordinals with Bitcoin ideals at the forefront of his design decisions. For example, the Ordinals implementation of digital artifacts is objectively superior to the way almost all NFTs were implemented on Ethereum and other chains. Danny Huuep describes the properties of a digital artifact, all of which Ordinals meet, extremely well:

Source: X

Imagine a piece of digital art worth $1 million, or imagine politically sensitive information like classified documents that detail government atrocities. Should these valuable or sensitive assets be distributed using technology that can easily disappear or that can be easily changed? The answer is obviously no. It’s also somewhat obvious that over time, the best artists, developers , activists, and investors will gravitate towards technology with stronger immutability that is capable of protecting their creation, information, or investment for hundreds or even thousands of years. In the case of digital art specifically, they will migrate to digital artifacts on Bitcoin that store the actual artwork, instead of NFTs that just point to where it’s stored on an off-chain server that could go down at any time.

Bitcoin stands alone atop the world of digital money, and the rise of Ordinals only cements that standing. This is not just about the idea of Bitcoin dominance in market capitalization terms, but the sheer dominance of Bitcoin’s principles and the vast potential of its immutable blockchain. With Ordinals unlocking unprecedented opportunities within the Bitcoin ecosystem, I see a seismic shift on the horizon. This shift should make Maximalists smile.

This is a guest post by L. Asher Corson. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Disclosure: L. Asher Corson is a partner at UTXO Management, subsidiary of BTC Inc., the parent company of Bitcoin Magazine

1 September 2023 17:30