Addressing Ordinal Concerns: Bitcoin Decentralization And Block Space

Bitcoin inscriptions have been out for a few more weeks, so we follow up on the fee market and block usage to observe what’s changed after 100,000 inscriptions.

The below is an excerpt from a recent edition of Bitcoin Magazine PRO, Bitcoin Magazine’s premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis straight to your inbox, subscribe now.

Addressing Bitcoin Decentralization & Block Space Concerns

New users have been flocking to Bitcoin to create what are known as inscriptions — often called NFTs (non-fungible tokens) on other blockchains. These mostly image files were increasing demand for Bitcoin block space, which caused some network participants to worry about Bitcoin’s future decentralization. If the cost to run a full node increases substantially due to users needing the storage space and bandwidth to download all this data that is unrelated to monetary transactions, fewer people might run full archival nodes, centralizing Bitcoin’s ledger.

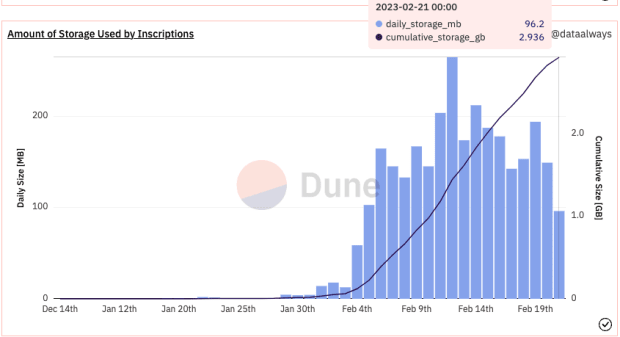

The amount of cumulative storage used by inscriptions continues to climb with almost 3 GB of storage specifically related to inscriptions at the time of writing.

Should the block space consistently be used to its full extent of 4 MB, it will add approximately 210.24 GB of data to the chain each year, which isn’t a major cost hindrance for running a full node but can still be considered pricey in places where technology isn’t as cheaply available. There is the ability to run a pruned node which does not require storage of any of this witness data and only keeps track of Bitcoin’s monetary transaction data. However, in order to create a pruned node, users still must download all of the data initially. This is where the concerns for insufficient bandwidth come into play. In areas of the world where there isn’t access to high-speed internet, the initial block download might take so long that it won’t be possible to sync to the chaintip.

That being said, the expectation for Bitcoin’s block space was always that it would be full at some point, which is partially why there is a cap on the block size. This cap was raised during the SegWit soft fork and included the fee discount for witness data — like inscriptions — that is unrelated to Bitcoin’s financial ledger and its unspent transaction output (UTXO) set.

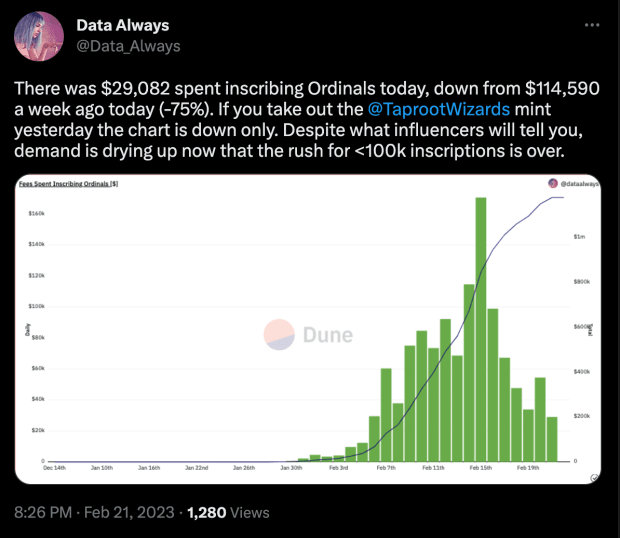

Bitcoin has been compared to a decentralized clock because of the way it keeps track of the order of transactions as they happen around the world. The nature of inscriptions on Bitcoin uses this ordering to number the inscriptions as they are written onto the blockchain, aka timechain. As the inscription count approached 100,000, people rushed to get their inscriptions confirmed before or exactly at that number. We saw the largest increase in fees around this time, which is shown above in dark green. By quickly glancing at the fee rate chart, it’s clear when the 100,000th inscription was made because of the most amount of fees greater than 25 sat/vByte.

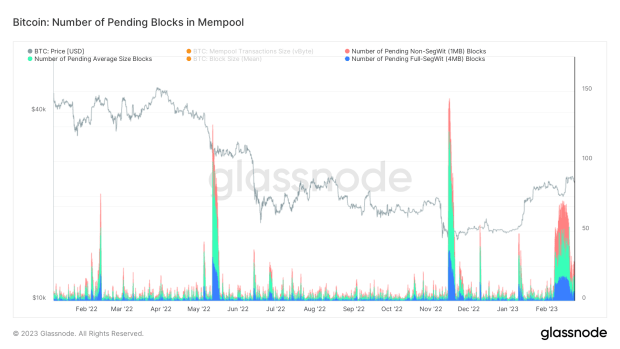

After this monumental inscription number, the rush to create NFTs on Bitcoin has drastically decreased. While there is still a backlog of transactions in the mempool, the fees required to get a transaction confirmed in the next block have dropped considerably and the daily total fees spent on creating inscriptions is “down only.”

Even though the fees are down along with the total amount of money being spent on inscriptions per day, the number of pending transactions in the mempool remain high and constant, with no signs of letting up in the short term.

In this past mining epoch, blocks are being mined so quickly that there is an expected difficulty adjustment of nearly +11%.

“The expected ratchet upward in mining difficulty will take away some of the relief that operations were feeling in recent weeks, due to the increase in USD-denominated revenue. Miner revenue denominated in bitcoin terms will once again head to new lows.” — State Of The Mining Industry: Public Miners Outperform Bitcoin

This rapid rate of mining blocks has allowed for some of the inscription transactions with lower fee rates to be mined because blocks were getting mined faster than new transactions were being broadcast to the network.

Now that the initial rush to be an early inscriber is likely over, one theory for inscriptions is that they will become a buyer of last resort for block space in times when fees are low and fewer people are transacting on chain.

We will see if this thesis plays out. It’s possible that times of lower fees will be used by people opening up Lightning channels as well, which is one of the arguments against inscriptions as they potentially crowd out Bitcoin’s financial use cases.

Final Note

There are unanswered questions about the bandwidth requirements for downloading an archival full node as well as the cultural questions of whether these non-monetary transactions should be happening on Bitcoin’s base layer or if it’s even possible to move them to a Layer 2.

Like this content? Subscribe now to receive PRO articles directly in your inbox.

Relevant Past Articles:

- Fee Market Competition: Bitcoin Ordinals And Inscriptions

- State Of The Mining Industry: Public Miners Outperform Bitcoin

- Earlier Than You Think: An Objective Look At Bitcoin Adoption

- State Of The Mining Industry: Survival Of The Fittest

- Bitcoin Sellers Exhausted, Accumulators HODL The Line

26 February 2023 08:00