Bitcoin ETF Inflows In Context

The below is an excerpt from a recent edition of Bitcoin Magazine Pro, Bitcoin Magazine’s premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis straight to your inbox, subscribe now.

The First 5 Days

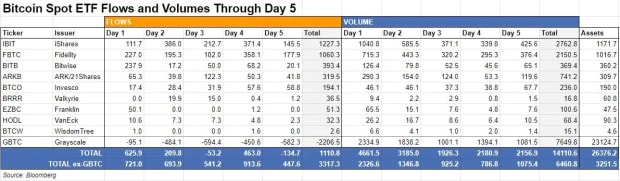

The Bitcoin spot ETF launch was one for the history books. By all accounts, it was the largest launch of an ETF product in history, beating out the previous record set by the Proshares Bitcoin Strategy ETF (BITO) launch in October 2021. First-day trading volume was huge at $4.6 billion, and it has remained relatively strong compared to typical post-launch declines of other products. We can be confident in the volume numbers, unlike the inflows. After the first two days of trading, the market was left wondering about flows because the data provided by TradFi was delayed and incomplete. Experts, such as Eric Balchunas of Bloomberg, said it was normal to have delays in reporting of flows by as much as T+3 (three days after). Bitcoin isn’t used to such bad transparency.

In the below table, you can see the GBTC outflows are now over $2 billion, with the largest day being Day 3. However, it is highly probable that most of Day 3’s flows was due to trading on Day 2, and likewise for Day 2 on Day 1, and so forth. We also cannot tell if all the issuers are up-to-date on their data. Is that all their flows or are they not done counting? We simply don’t know.

Bitcoiners are supplementing slow TradFi data which can take days by tracking flows on-chain. On Wednesday morning, James Van Straten of Cryptoslate reported that 18,400 bitcoin were sent from Grayscale to Coinbase’s Prime OTC desk right at market open, following a pattern of outflows on the two previous trading days of 9,000 bitcoin on January 16 and 4,000 bitcoin on January 12. The on-chain data from intelligence firm Arkham is trustworthy, the problem is it doesn’t match the reported outflows. Those three days of on-chain data add up to $1.3 billion worth of bitcoin and the reported outflows were only $1.1 billion. Also, interestingly there were no transactions the morning on January 18, but they resumed this morning.

Source: Arkham via @DylanLeClair_

Coinbase already custodies Grayscale’s bitcoin, so these are transfers from their custody account to the OTC desk, where other ETF market makers can pick it up, limiting the effect on the spot price.

GBTC Selling Could Be Drawing to a Close

Grayscale selling was expected but we still don’t know the ultimate amount that will end up being sold by the time the dust settles. Will 100% of their coins slowly come out, or perhaps only 10%? People are speculating the expense ratio of 1.5% versus the other ETFs averaging 0.25% might cause people to swap ETFs. If that is the case, it would not translate into any net selling. GBTC did lower their fee when they converted, from 2% down to the new 1.5%. If GBTC holders are sitting on significant unrealized gains, they might choose not to sell until the next rally. Remember, there are tax implications with swapping, also.

Many early sellers of GBTC are doing so for ideological reasons. The discount which formed in Feb 2021 took them by surprise and they felt stuck. The question is how many bitcoin is that? GBTC still has over 550,000 bitcoin as of January 19, how many of those still feel stuck? Why wouldn’t they have already swapped out in the first several trading days? I think it is less than people think. Yes, all of the bitcoin will come out eventually if they keep the expense ratio that high, but not in one sustained movement. I think the dumping will be spread out over several large rallies in the bull market. Selling from GBTC might already be slowing with the discount to NAV dropping from 150 bps on day 1 to 47 bps on January 17.

Bitcoin Price

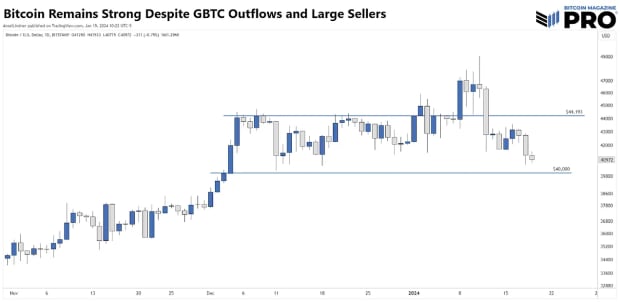

Speaking of price, bitcoin has managed to hold support at $40,000 even with the massive outflows from GBTC and whale selling. Again, James Van Straten reports a whale who bought at $48,000 in 2021’s bull market, who held through the massive drawdown and the FTX debacle, possibly unloaded 100,000 BTC with an ask of $49,000. For context, all the ETFs ex-GBTC are still below that at 79,000 BTC. This was not a sell-the-news event, it could have simply been a whale selling after breaking even. Meaning the consistent buying pressure of the ETFs is only delayed by a week or so.

We are still in the range dating all the way back to the beginning of December, but are threatening to fall below it right now. My attention remains on $40,000 and the $44,193 line we’ve been watching that whole time, created from the high daily close back on December 8.

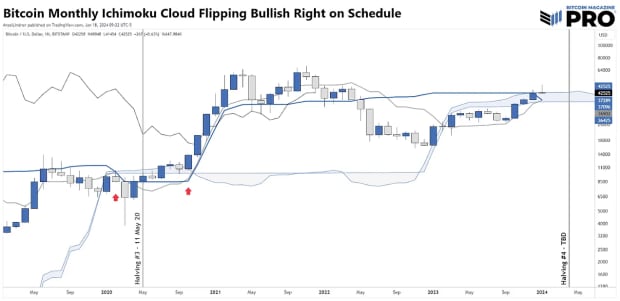

For those readers with beautiful low time preference, the monthly Ichimoku cloud is flipping bullish. This is an extremely bullish signal that only happens at the beginning of bull runs in bitcoin. It occurred last in October 2020 after almost flipping prior to COVID in February 2020. Interestingly, if it would have flipped in February, it would be at very nearly the same relation to the halving that we are today. Prior to 2020, the only other time this has occurred was in June 2016, at the beginning of that massive bull market, and one month prior to the July 2016 halving.

Massive Buying Pressure in Context

Using the incomplete inflow data above, we can say that the average daily buying pressure, including GBTC selling, has been more than $200 million/day. Interesting that Day 4 was the second highest, adding some evidence to the theory that buying pressure might level out around the $250-300 million mark. To put that amount in context, Microstrategy just began a 4-month process of selling $216 million in new shares to buy more bitcoin. The ETFs do that in a day. Tether is also constantly buying bitcoin for their reserves. Recently, they reported adding another $380 million in bitcoin at the end of 2023. Two out of the first five days of the ETFs were more than that.

With all those sources of gigantic demand in mind, look again at the monthly chart above, again. There is one way for this market to go. Are you ready?

If you liked this post, please give it a like and share on social media so we can spread our message! Thank you!

24 January 2024 14:49