How Erlay Helps Preserve Bitcoin’s Decentralization

Erlay is a new relay protocol that seeks to minimize the bandwidth usage required to connect Bitcoin full nodes.

This is an opinion editorial by Kudzai Kutukwa, a passionate financial inclusion advocate who was recognized by Fast Company magazine as one of South Africa’s top-20 young entrepreneurs under 30.

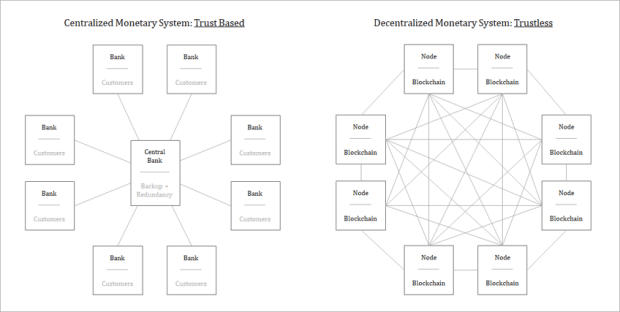

Satoshi Nakamoto brilliantly laid out in a few short sentences the major problem with the current financial system; it’s dependency on trust. “The root problem with conventional currency is all the trust that’s required to make it work. The central bank must be trusted not to debase the currency, but the history of fiat currencies is full of breaches of that trust. Banks must be trusted to hold our money and transfer it electronically, but they lend it out in waves of credit bubbles with barely a fraction in reserve.” In other words what really drives the fiat monetary to a great extent is trust, because without it the system as we know it wouldn’t be functional, however the trust is being placed in untrustworthy individuals and institutions. The Bitcoin monetary system is trustless and decentralized by design and is reliant on cryptographic proof instead, thus removing altogether the need for “trusted intermediaries” in every financial interaction, from the central bank all the way down to transactions between individuals.

The Blocksize War of 2015-2017 is one of the most significant events in Bitcoin’s history. This was really a battle between those that favored centralization of the protocol by a handful of developers, exchanges and miners (akin to what you have in Ethereum today) versus those that favored decentralization, security and resilience over the long term. For the first time in its existence Bitcoin faced a potential hostile takeover engineered by powerful corporate entities that wanted to capture and impose their will on Bitcoin. What started out as a disagreement on how to scale Bitcoin, whether the size limit of the blocks that make up the Bitcoin blockchain should be increased or not, eventually morphed into a two year long tug of war over the very soul of Bitcoin itself. Two camps emerged; the “big blockers”, who were in favor of increasing the block size as their priority was ensuring faster and cheaper transactions at the base layer thus making Bitcoin into a global payments system that would rival Visa (i.e. corporate control); and the “small blockers” who were more focused on Bitcoin being a new form of money, which had to remain fully decentralized if it was to achieve the goal of separating money and state (i.e. individual control).

Jan3 CEO, Samson Mow, who was at the frontlines of the block size war, in a recent article made the following remark about the small blockers, “They prioritized integrity, resilience and security, arguing that if blocks became big, it would become expensive for users to run a node and would thus incentivize hosting nodes in data centers; a one-way street towards centralization and control by a few, not much different from other systems like banks. This would mean the death of the dream of an apolitical, incorruptible, decentralized money.” The small blockers foresaw a scenario in which overtime it would be expensive for users to run full Bitcoin nodes which would have led to further centralization and thus recreating the trusted third parties in another form; the very middlemen that Bitcoin was designed to disrupt. Satoshi designed Bitcoin with the intention of it remaining a technically and socially robust peer-to-peer (P2P) network which should never be “corrupted” through centralization. He summarized it this way, “Digital signatures provide part of the solution, but the main benefits are lost if a trusted party is still required to prevent double-spending.”

In order for Bitcoin to remain user-controlled, every attempt or form of centralization has to be fiercely resisted, especially given the innate human tendency to lean more towards centralized systems with a leader. If a handful of business entities and developers could force such a significant change without consensus would that not be akin to how the Federal Reserve plans the economy by dictating interest rates and maintaining “price stability?” As stated earlier, it wasn’t just about block sizes anymore but it was now an ideological clash about control. Who had control, was it the users or the miners or the developers that would steer the protocol? In the book, “The Blocksize War,” the author accurately described this phenomenon and how it was an underlying driver for the big blockers when he noted;

“In some people’s minds, the idea of a system controlled by end users is too difficult to grasp. Instead, they look for somebody or some entity who controls the system. Some people cannot fathom the idea of a system which has global consensus, but lacks a leader…As for whether Bitcoin really is the leaderless system it proclaims to be and whether this will always remain the case, the jury is still out. However, after the drama and shenanigans of the blocksize war, one thing is clear: there is still hope that the claim is true.”

Ultimately, it was the small blockers that prevailed and as a result Bitcoin remained firmly in the users’ control.

When it comes to Bitcoin most of the attention is focused on bitcoin the asset and less on the infrastructure required to maintain this global, decentralized peer-to-peer (P2P) network. While the small blockers’ victory in the blocksize war secured Bitcoin’s path towards future mass adoption, it still remains unclear to most people why running a node is so important that it was worth fighting for. Let’s start by defining what a node is. A full node is any computer that maintains and stores the entire Bitcoin blockchain; in order to verify and record new transactions as they happen, according to a common set of network consensus rules. In the absence of a central party, it’s these nodes that act as referees of the Bitcoin network by independently validating all transactions and blocks; and filtering out invalid transactions. This is how the Bitcoin network removes trust in any centralized entity and ensures the integrity of its 21 million supply cap.

While running a full node is important, it’s still optional to do so. Running a full node, grants anyone the ability to broadcast transactions (or blocks) on a permissionless basis. The more nodes there are on the network, the more decentralized Bitcoin becomes. This not only increases redundancy, but it results in Bitcoin being more secure by making it increasingly harder to corrupt or censor. Each full node executes the consensus rules of the network, an important element being Bitcoin’s fixed supply. Bitcoin Core developer, Luke Dashjr, perfectly summarized it this way, “All of Bitcoin’s advantages — including its security from outright theft and the 21 million BTC cap — stem from the assumption that the majority of the economy are using their own full nodes to verify payments to them. Centralized verification and third-party/custodial wallets are a bigger threat to Bitcoin than anything else.” In other words, nodes are very important parts of the Bitcoin network’s defense mechanism with regards to processing transactions, and they are the last line of defense against centralization and malicious actors. More information regarding running your own node can be found here.

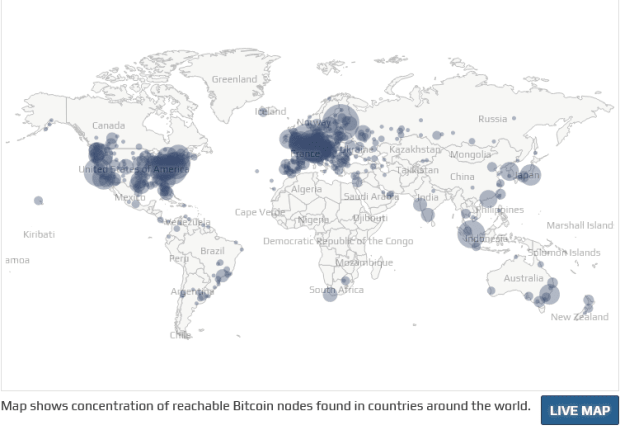

Despite the critical role that nodes play in the Bitcoin ecosystem, it’s estimated that the number of Bitcoin nodes has dropped considerably from a peak of 200,000 in 2018 to less than 45,000 today as of time of writing according to Dashjr’s data. Given the fact that users being able to run full nodes was one of the biggest factors that culminated in the blocksize war, it’s definitely of great concern that we are seeing a reduction of nodes on the network in 2022 when compared with 2018. This could potentially make the Bitcoin network less secure and much more prone to centralization. Furthermore from a geographical standpoint, 32.8% of Bitcoin nodes globally are located in just seven countries — the United States, Germany, France, the Netherlands, Canada, Finland and the United Kingdom, as of time of writing according to data from BTC nodes analytics platform Bitnodes.

Ironically in the global south where there is a huge need for Bitcoin from a financial inclusion perspective, there is a paucity of Bitcoin nodes in that part of the world. There are numerous reasons that can explain the decrease of Bitcoin nodes or the lack thereof in other regions; firstly there are a lot of people that are not educated about the importance of running a full Bitcoin node, especially given the current obsession with number go up. Secondly, due to the significant bandwidth usage of Bitcoin full nodes especially as the network scales, the costs of doing so are prohibitive; especially in places with subpar internet connectivity. This is where Erlay comes in. Erlay is a new efficient transaction relay protocol that aims to significantly minimize the bandwidth usage required to connect Bitcoin full nodes.

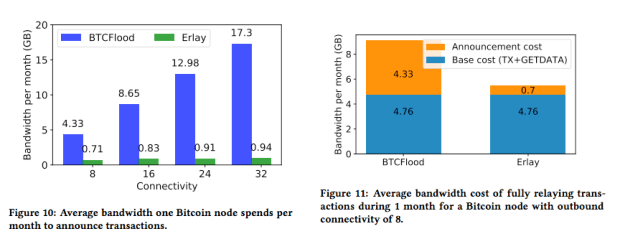

Approximately 50% of the bandwidth required to run a Bitcoin node is used just for announcing transactions. When a new bitcoin transaction is broadcast, it is sent to all nodes on Bitcoin’s p2p network and this occurs in two ways. Firstly, after receiving a transaction, a node sends a transaction identifier (i.e. transaction ID) to all of the peers it’s connected with. This transaction ID is subsequently verified by all these peers to ensure that they haven’t received the transaction in question from another peer. If not, the whole transaction is requested from the node that sent the transaction ID. This process repeats continuously and the end result is that there is a plethora of redundant messages being shared on the Bitcoin network, thus unnecessarily consuming a lot of bandwidth. It’s estimated that 44% of overall bandwidth used between nodes consists of these redundant messages. The long and short of it is that this approach has high redundancy and poor bandwidth efficiency. The bandwidth costs therefore become a huge impediment for some users to run a full node, which severely limits the extent of decentralization of the network.

Secondly, the decentralized nature of the network gives rise to another critical issue with regards to Bitcoin’s node connectivity, which is that it also uses large amounts of bandwidth to keep the connection open with all the other nodes. In other words the current protocol increases bandwidth consumption as the number of connections between nodes increases. This also increases the costs to run a Bitcoin full node as the network scales, which would make the network more prone to centralization. Over and above that, since the security of the Bitcoin network is heavily reliant on the connectivity between nodes (i.e. higher connectivity results in a more secure network) fewer connections between nodes would be bandwidth efficient but would result in a less secure and borderline centralized network. According to the white paper that was co-authored by Gleb Naumenko, Bryan Bishop, Pieter Wuille, Greg Maxwell, Alexandara Fedorova and Ivan Beschastnikh; Erlay will reduce the amount of bandwidth required to maintain current levels of connectivity between Bitcoin nodes by 40%, while simultaneously maintaining bandwidth usage as the connectivity between nodes increases. To put this in perspective, currently a connection to 32 nodes utilizes approximately 17.3GB per month to relay transactions and Erlay drastically reduces this to a meager 0.94GB per month! This is a huge quantum leap for bandwidth efficiency as shown by the diagrams below:

The paper further states that; “By allowing more connections at a small cost, Erlay improves the security of the Bitcoin network. And, as we demonstrate, Erlay also hardens the network against attacks that attempt to learn the origin node of a transaction.” In other words Erlay significantly improves bandwidth efficiency by reducing bandwidth used for transaction relay as well as scalability of connections between peers thus making the network more resistant to partitioning attacks and fortifies single nodes against eclipse attacks. While Erlay protocol support signaling has successfully merged into Bitcoin core, this was a development that took three and a half years to materialize, given the extensive review and testing that had to be done beforehand, because stability and security at the base layer are everything.

While Bitcoin is a significant breakthrough in creating a trustless and decentralized monetary system with superior monetary properties, its success is not guaranteed unless we the users remain committed to defending the principles upon which it is anchored. The victory by the small blockers in the blocksize war wasn’t handed to them on a silver platter but it came about through relentless commitment to the goal of separation of money and state. It was all or nothing. Many more attempts to control Bitcoin at the protocol level will be launched, however they will be doomed to fail if we remain resolute and unwavering in preserving the network’s core tenets; of which decentralization is chief among them, in my humble opinion. By keeping the costs of running a node as low as possible,more individual users from around the world are able to participate in validating the network, this is what Erlay represents. It’s a defense against centralization of the network by larger players thus preserving Bitcoin’s identity as a fully decentralized, permissionless and trustless peer-to-peer monetary system.

This is a guest post by Kudzai Kutukwa. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc. or Bitcoin Magazine.

10 December 2022 02:24