Is Your Money Safe During The Banking Crisis?

This is an opinion editorial by Brad Mills, host of the Magic Internet Money Podcast and an investor in several Bitcoin-focused projects.

Big banks are failing. Credit Suisse, one of the largest globally-systemic important banks (G-SIBs) in the world at $1.2 trillion in total assets, has recently failed, requiring a bailout from the Swiss central bank.

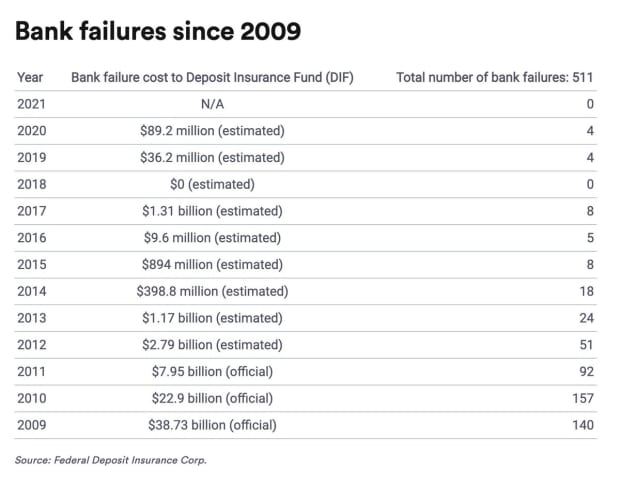

Before the era of quantitative easing (QE), Term Asset-Backed Securities Loan Facility (TARF) and Troubled Assets Relief Program (TARP) bailouts, bank failures were common. Allowing excess risk to flush from the system is a healthy part of free markets. Almost 500 banks failed during the Great Financial Crisis (GFC).

During the last decade of QE, barely any banks failed while economists, central bankers and politicians have been continually and confidently assuring us that their stress tests are keeping the banking system sound.

Is it a coincidence that during the last decade, as governments, central banks and commercial banks worked together to expand the money supply faster and higher than ever before in history, that banks stopped failing?

Have banks stopped failing over the last seven to eight years because banks are safer and more conservative, or is it because record amounts of money printing and government bailouts have moved the risk from bank balance sheets to somewhere else, simply delaying the inevitable?

Did moving this risk from bank balance sheets to the central bank’s balance sheets via deficit spending, stimulus, QE and bailouts actually help keep your deposits safer, or has it actually caused wealth inequality to rise, debased the value of your savings account and contributed to high inflation rates which makes the dollars in your bank worth less?

Finally, after all of this, are we about to see a reversion to the mean of bank failures anyway? Is there a way to protect yourself from the extremely-unlikely event of hyperinflation, or the more-likely event of a deflationary bust or continued high inflation due to governments printing money to prevent the collapse of the global banking system and the loss of confidence in the currency itself?

Deposit Insurance Turned Into A Confidence Game

Economists and policymakers cite Federal Deposit Insurance Corporation (FDIC) and Canada Deposit Insurance Corporation (CDIC) insurance and post-GFC regulations like the Dodd-Frank Act and Basel III stress tests to assuage our concerns, telling us that the banks are healthy and that the banking system is sound.

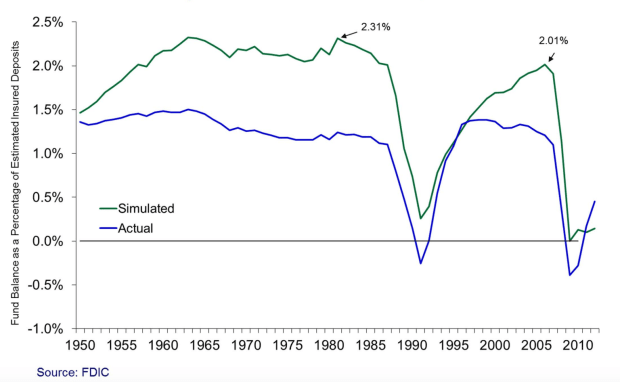

The reality is that the insurance fund is woefully undercapitalized to cover large bank failures.

In the U.S., there is more than $18 trillion in deposits and only about $125 billion in the FDIC fund. Warren Buffet’s Berkshire Hathaway has more money than the FDIC.

FDIC insurance was put into place in 1933 during the Great Depression as a way to provide confidence in the banking system. A lot has changed since 1933. The money supply used to be constrained by the amount of gold that was backing dollars. There was still fractional-reserve lending, but it was a lot more conservative back then.

While we were on a sound money standard, it was plausible that the FDIC and CDIC could act as a legitimate insurance policy for depositors, when coupled with strong bank regulations and balanced budgets.

However, the FDIC’s reserves have failed to keep up with the growth in the money supply, and it has had to be bailed out in some form or another during the 1990s, in 2008 and 2009 and, most recently, with the latest round of bank failures.

Deposit insurance is just another strategy in the confidence game designed to distract you from discovering the reality of how money and banking work.

Addressing Fractional Reserve Banking And The ‘Money Multiplier’

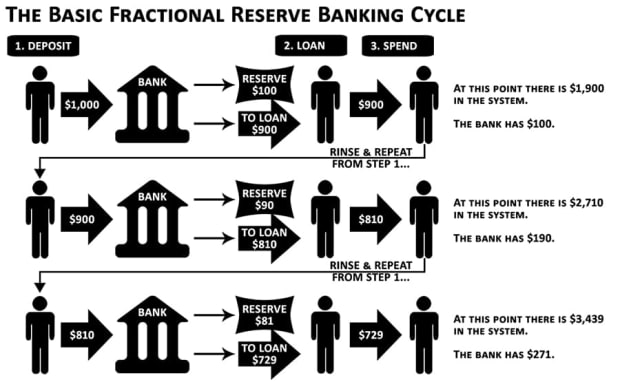

Many think that we operate on a fractional-reserve bank system that enables the “money multiplier,” but this is a common misconception as banks do not operate on that system anymore. Banks literally have the license to print money from nothing and the “money multiplier” is a myth.

You may have seen fractional-reserve banking and the money multiplier described as the bank keeping 10% of your deposit as reserves and lending the rest out, then repeating that process until the original deposit is multiplied upwards of ten times.

When you deposit $1,000 into the bank, there is no formula that says the bank keeps 10% of that as reserves and then it can loan $900 to someone else, repeating this ad nauseum until $1,000 becomes $10,000.

In reality, it’s “fictional reserve” banking, because the money lent out by banks is not backed by anything tangible and the debt that the government issues continually expands. The national debt will never be paid off and the banks have no reserve requirements anymore.

Many smart people reject this framing. They can’t accept that this is how the monetary system works.

Don’t feel bad if you’re confused about this stuff. It’s an opaque process designed to obfuscate the reality of how the purchasing power of money will always be debased.

The modern banking system is like a computer operating system where a small group of people have root-level administrator access, and they give a group of their friends a god mode cheat code.

The reality is that “BankOS” has been architected as a system of control and a wealth transfer mechanism from the bottom to the top… and you’re probably not at the top.

Many smart people who believe they understand the banking system are confused about how banks issue loans, they believe that banks conservatively issue new loans based on the amount of deposits they have. They believe that as customer deposits grow, banks lend that money out, and since the money had to exist in order for the bank to lend it out, the banks didn’t print the money.

This is a naive understanding, and it does not serve your interests to believe in this fairytale.

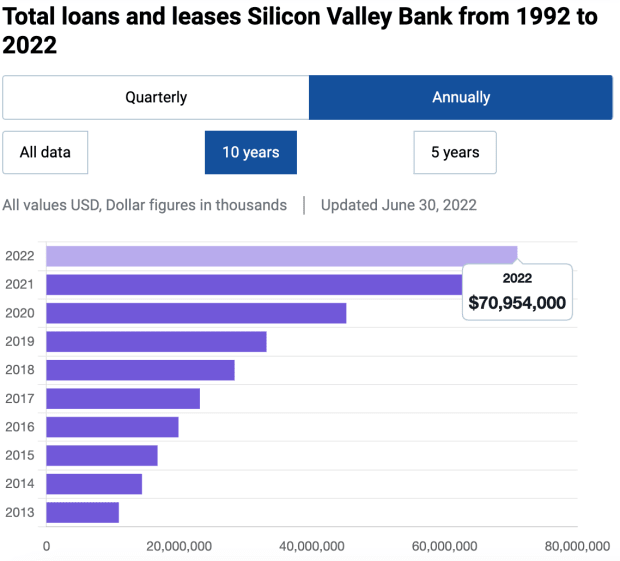

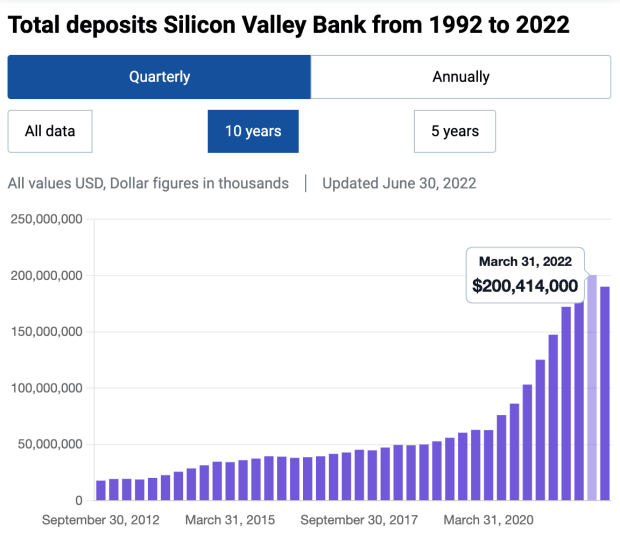

Let’s take Silicon Valley Bank (SVB), for example, the third-largest bank to collapse in U.S. history.

My smart friends will look at the above graphs and say, “See, Silicon Valley Bank didn’t just make money from nothing; they received lots of new deposits over the years and loaned out those deposits!”

They will see that the bank ended with about $200 billion in deposits and about $70 billion in loans and mistakenly think that the bank was conservatively lending existing money, not creating new money.

But the hard-to-accept reality is that the incoming deposits were actually created when a bank made a loan.

Maybe it was Silicon Valley Bank that created the deposits from nothing, maybe it was another bank — but the majority of the “deposits” in the banking system are created from nothing by banks.

My smart friends will say, “This makes no sense, if banks can create money from nothing, why wouldn’t they just continually print money to make unlimited profits?”

The truth is, when you look at the growth of the money supply, that’s what they do.

As long as there’s demand for borrowing, banks will lend. They have a license to print the money and a license to charge usurious levels of interest on the money.

It’s a wonder why banks fail at all under a system where they have a license to expand the money supply through issuing loans, constrained primarily by our demand for borrowing and what they deem your “creditworthiness” to be.

Most of the “money” in the system is actually just created from nothing this way by banks — and as icing on the cake, when you deposit this created-from-nothing-by a bank “money” into a bank, they also take your deposits and invest them in the treasury market or deposit them to the central bank as bank reserves to make even more profits.

The moment that you deposit money into a bank account, it becomes a liability on the bank’s balance sheet and is no longer “your money.”

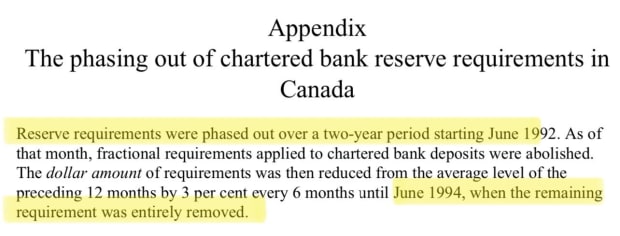

Bank regulations are part of the confidence game, designed to prevent bank runs by depositors. In March 2020, the reserve requirements for U.S. banks were lifted, and many British Commonwealth countries have been on a zero-reserve requirement regulatory scheme for 20 to 30 years.

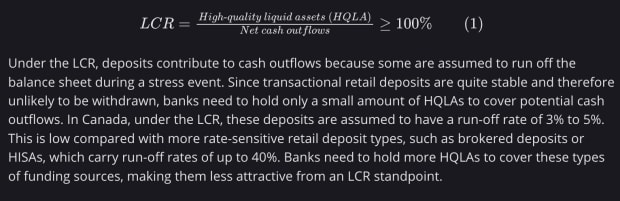

Instead of 8% to 12% reserve requirements, there are various liquidity and collateral rules that banks are urged to follow. One of these rules is the liquidity coverage ratio, or LCR.

LCR is important when it comes to bank runs, which is what we are seeing happen now across the global banking system.

In order to pass regulatory stress tests, banks must keep a portion of their reserves in high-quality liquid assets (HQLA) which include cash and cash-like instruments such as government bonds that can be quickly sold to meet customer withdrawals.

Banks must always have enough high-quality liquid assets in order to meet 30 days of expected net outflows and customer withdrawals.

The Bank of Canada assumes that customer deposits in the country’s ”Big Six” banks are very sticky, so it only assigns a run-off rate of 3% to 5% and these banks are not required to keep significant HQLAs to cover deposits.

The problem arises when there is a systemic crisis in either the banking system or the money itself that causes fear and panic, driving people to withdraw their money physically or wire it out digitally.

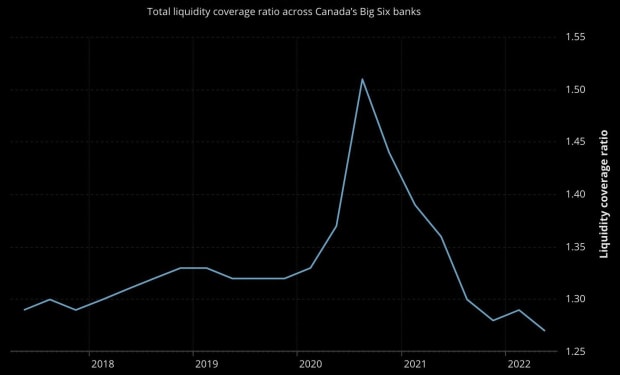

In 2022, when Canada Prime Minister Justin Trudeau and Deputy Prime Minister Chrystia Freeland invoked the Emergencies Act and threatened to freeze the bank accounts of anyone involved in or supporting the Freedom Convoy, this caused a run on the Canadian banks, as shown by the LCR chart below.

This sudden shock and erosion of trust in the Canadian banking system from a large enough percentage of the population caused the LCR of Canada’s biggest banks to drop significantly.

When a bank run happens, 30 days’ worth of expected net outflows might be taken out in one day, leaving the bank potentially insolvent if there are liquidity issues with the high-quality liquid assets the bank uses for its HQLA reserves.

‘Too Big To Fail’: How The Current Bank Failures Are Not Like 2008

So, now that we know that the money multiplier is a myth and banks are actually allowed to create credit (money) from nothing via fictional-reserve banking, authorized by the central bank, let’s continue!

Why did we not see any signs of bank failures during the last 10 years until now?

It turns out that the central bankers kept interest rates near zero while they recapitalized banks and monetized record government debt issuance (deficit spending) to the tune of trillions of dollars. In that environment, banks appear to be healthy.

If the government gave you a money printer, I’m sure your finances would be a lot more sound as well!

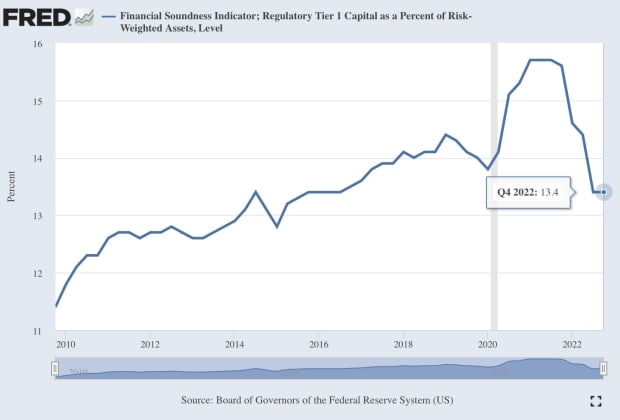

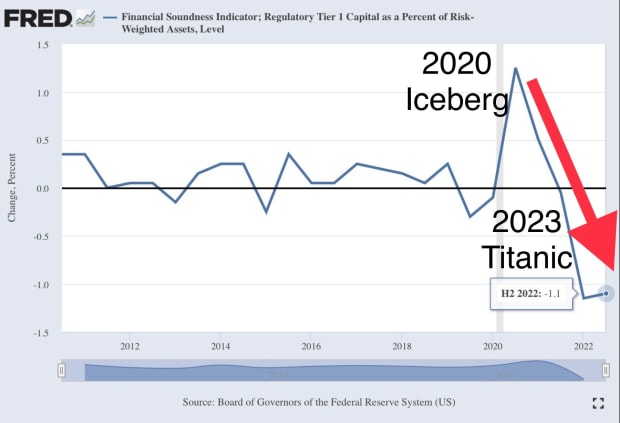

There is a “financial soundness” indicator that the central banks use known as a Common Equity Tier 1 (CET1) ratio, which is also known as a capital buffer.

In the chart below, thanks to QE and other bailout programs, you can see that the soundness of the banks increased until recently, when we saw the largest percentage drop of CET1 since they started measuring it.

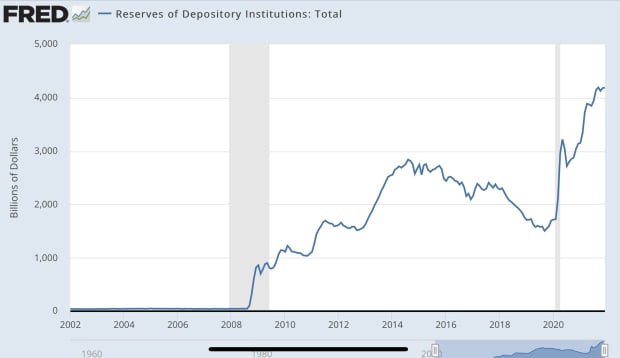

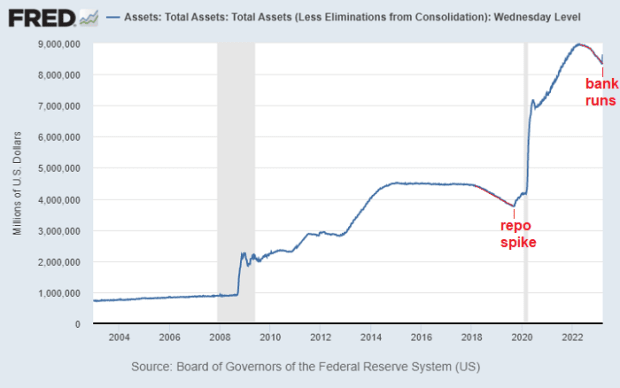

U.S. banks went from having nearly zero excess reserves pre-2008, to being continually injected with hundreds of billions per year via bailouts and QE until the total reserves parked at the Federal Reserve peaked at an astronomical $4 trillion recently.

The last banking crisis was caused by too much real estate speculation by the public and too much toxic, derivative-risk taking by big banks.

The big banks were deemed “too big to fail.” In order to save the flawed system, they threw out the idea of being fiscally conservative and started normalizing bailouts as the first resort.

We are 50 years into the backed-by-nothing U.S. dollar experiment and nearly 15 years into this infinite, reserve-banking, central-planning experiment, and it looks like everything is broken, especially the purchasing power of dollar savers.

Too much centralization and interference in financial markets to save the “too big to fail” banks has shown up as an acceleration of the perversion of incentives in the economy.

The role of the dollar went from being a savings vehicle — work hard and save your money — to a system of control and wealth redistribution from the bottom to the top — work hard and spend your money.

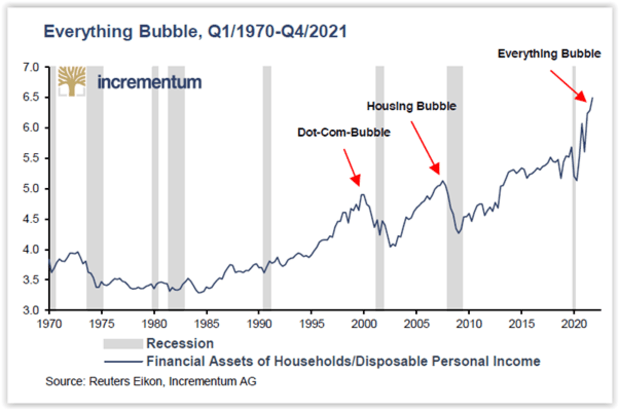

Due to this new ‘too big to fail’ experiment, we’ve seen the rise of the “everything bubble,” which makes this crisis much different than the last one. The current crisis is a crisis of confidence in the money itself and the entire banking system, not necessarily anything that the banks did.

How Did Governments And Central Banks Cause The Everything Bubble?

Interest rates were held artificially low during this period of time. With the central bankers signaling that rates would be held lower for longer, this encouraged over borrowing and excessive risk taking by banks, corporations and citizens.

Combine this poor central banking policy with gluttonous government deficit spending and we see the total supply of money rise exponentially.

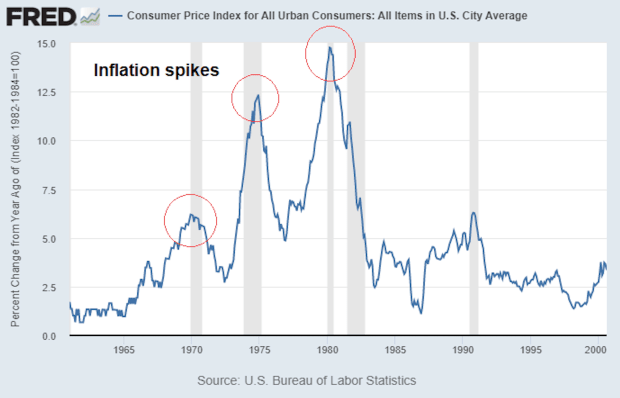

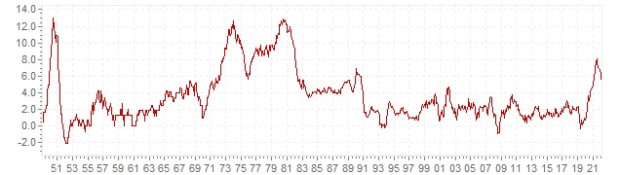

When you add in the supply chain disruptions from the “end of the age of abundance” as French president Davos aficionado Emmanuel Macron recently warned about — all of this has caused inflation to rise faster than my generation has seen in our lifetimes.

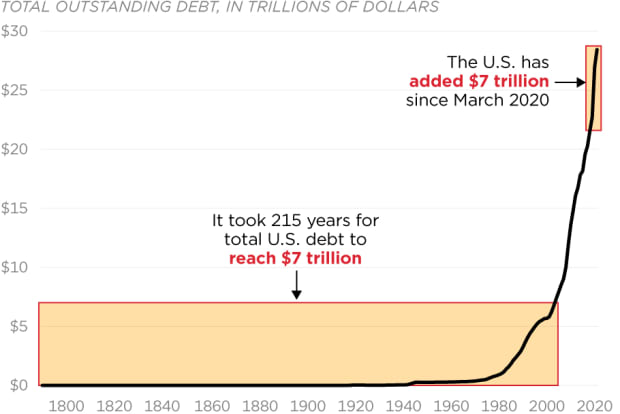

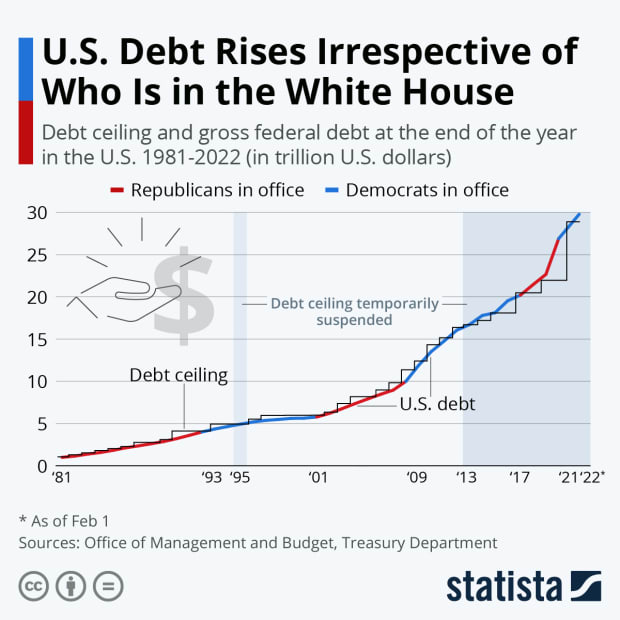

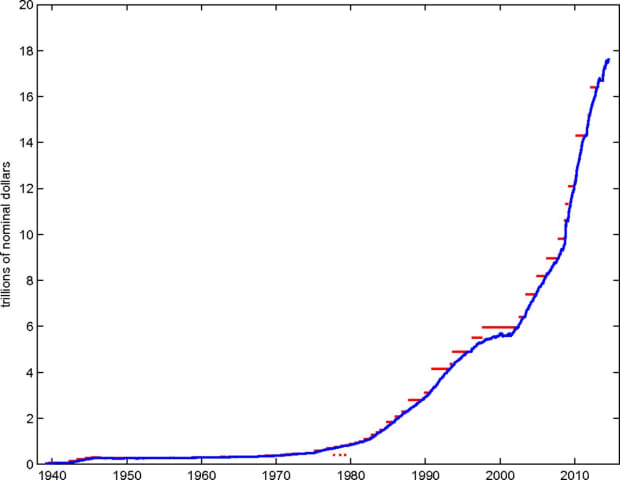

The U.S.’s national debt increased from a staggering $10 trillion to a mind-numbing $30 trillion since the 2008 to 2009 GFC.

The money supply has inflated massively. It took the U.S. two centuries to accrue $7 trillion in national debt until recently, when $7 trillion was added in just another two years!

Price inflation is the highest it’s been in decades.

Labor participation is the lowest it’s been in decades.

Wealth inequality is continually going in the wrong direction since 1971 and has accelerated during the QE period.

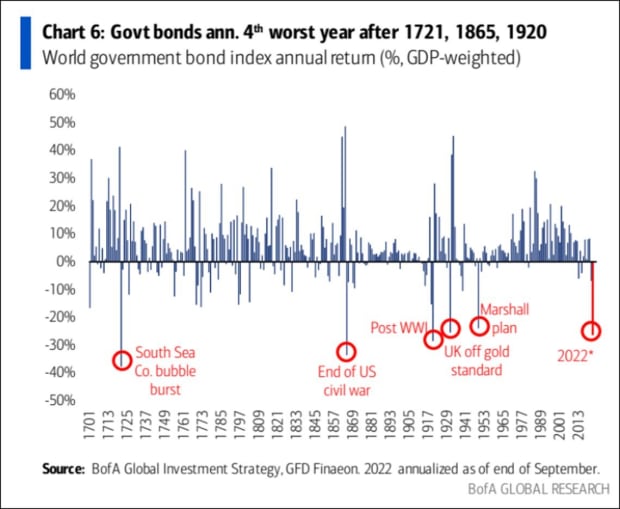

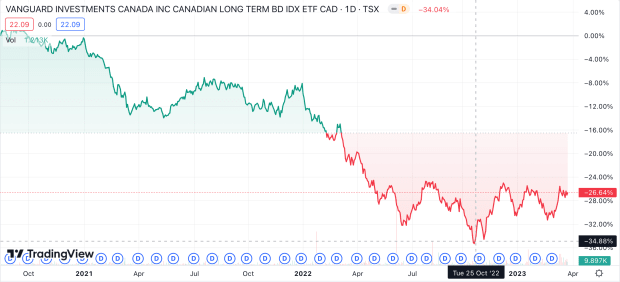

The bond markets are more volatile now than they have been in decades, and 2022 was the worst year for stocks and bonds since 1920.

The ballooning of the money supply and growth of the debt-based monetary system is not a left versus right phenomenon — at least in America — both sides have presided over the destruction of the dollar’s purchasing power and the weakening of the banking system.

What Does History Tell Us About What Might Come Next?

It’s very difficult to look at the past and figure out which period of history this is most like.

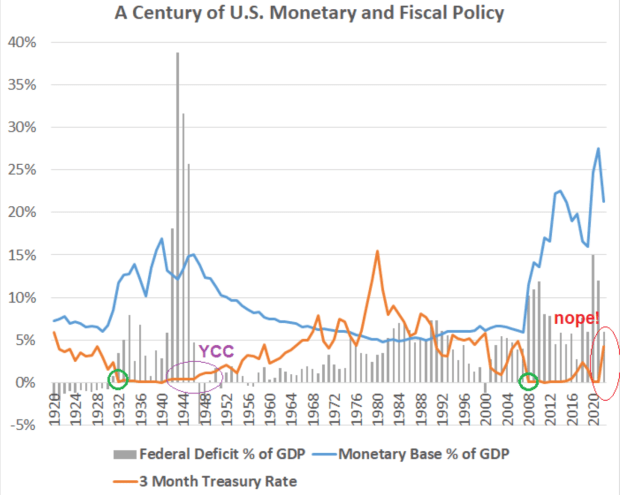

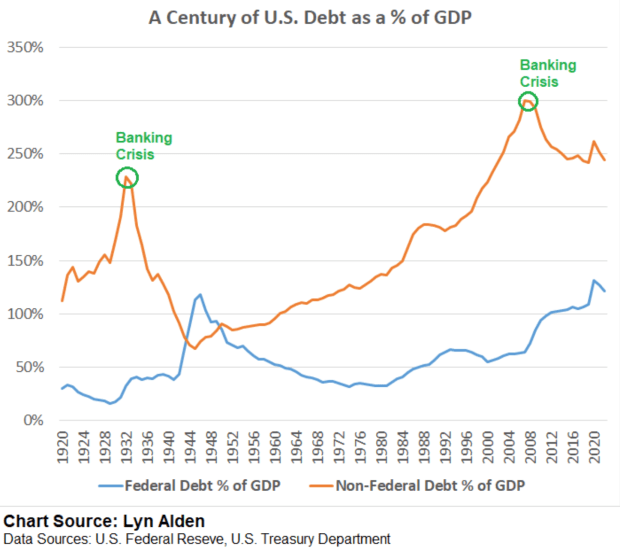

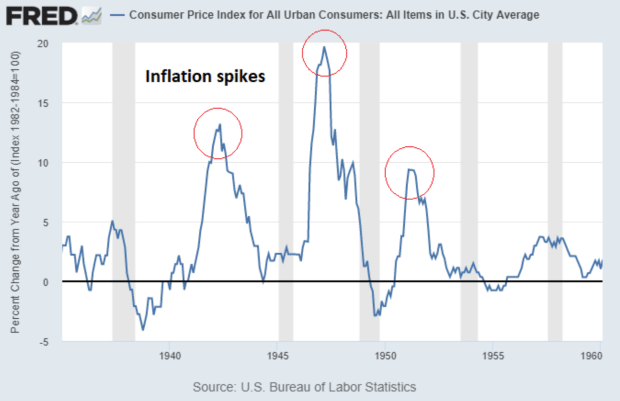

Independent analyst Lyn Alden has pointed out that if you take a very long term view of the economy and the financial system, the most relevant period of time to compare this to is the 1930s and 1940s.

Since the dollar has lost nearly 97% of its purchasing power over the last 100 years, and the supply of money has changed by orders of magnitudes, she’s devised a proxy measuring stick of using percentage of GDP.

Aside from 1940s-style inflation, another correlation to that time period is the explosive growth in the debt-to-GDP ratio that we currently face compared to what it was during World War II.

Yield Curve Control (YCC) is basically when a central bank needs to intervene with the bond markets to manipulate the interest rate by mandate, rather than letting the free market sort it out.

Alden points out that, similar to the 1930s, in 2003 interest rates were cut to 1%, which caused banks and citizens to take on lots of debt and risk. Then, in 2004 to 2006, the rates were jacked up, which caused the housing crisis that surfaced a few years later — leading to the banking crisis.

The can was kicked down the road until 2020 to 2021, when interest rates were cut all the way to zero while central bankers were printing money and conducting QE.

In 2022 to 2023, the rates were jacked up, causing the current banking crisis.

Alden also points out that in the 1940s as well as in the 1970s, inflation came in waves, and she expects the same to happen over the next decade.

In January 2022, during a House of Commons of Canada session, Conservative Party Pierre Poilievre Leader gave a speech on the history of money, educating fellow MPs about the follies of money printing and how it causes inflation:

“We have not been immune to this inflationary disease. In the post-war era, we inherited monstrous debts fighting the fascists. We basically operated on an American-led standard whereby you could exchange a U.S. greenback at a rate of $35 per ounce in gold.”

Poilievre continued talking about the prosperity we had in the post-war era under the gold standard:

“Here in Canada, with solid currency, we wrestled the inflationary beast to the ground. We paid off our record war debts, we increased the size of the Canadian economy by 300%, and by 1973 we had basically become a debt-free country.”

“Then what happened in the 1970s?” he continued. “President Nixon wanted to spend on warfare and welfare. Of course, the Americans were bogged down in Vietnam, which was costly an enterprise. President Nixon wanted to keep his popularity at home, so he decided to spend, spend, spend… In the decade that followed 1971, not only did they unleash the American dollar from a sound money standard, but they increased the number of U.S. dollars in circulation by 150% while output only grew by 39%. In other words, the amount of money grew about four-times faster than the amount of underlying output that that money represented.”

This next part gets a bit partisan, but it’s very relevant to what we’re experiencing now.

Poilievre continued, “Here in Canada, we had Pierre Elliot Trudeau as prime minister. He looked down at all the inflation that the U.S. government was creating — they had reached double-digit inflation, a total inflationary crisis.

“The American dollar was devalued on an international basis, incapable of buying affordable petroleum on the world market … poverty was overtaking inner-city streets and the wealth gap was expanding in the United States of America.

“What did Pierre Elliot Trudeau do? He started printing money here in Canada, massively increasing the money supply. Between 1971 and 1981, the money supply in Canada grew by over 200% while GDP only grew in real terms by about 47%.

“So you can imagine when money is growing in supply at more than four times the rate as the economy is growing, you have more dollars chasing fewer goods, and what do you get?”

Inflation.

Why Deflation Is Good And Prices Should Come Down, If It Weren’t For Central Banks And Politicians

Not only are we dealing with government-induced inflation, but we’re also now suffering from their proposed solution to inflation: jacking up the interest rates and crushing everyone financially.

The banking crisis was never fully dealt with in 2008 and 2009.

Instead of taking a decade of pain, allowing rates to naturally rise while over-leveraged, large banks failed and poorly run businesses went under, they decided to socialize the losses and privatize the gains.

Not only was the can kicked down the road, but central bankers and economists tried to sell us on being scared of deflation!

They were trying to rationalize their monetary machinations as a way to stop prices from dropping, trying to fear monger and convince all of us that lower prices is a bad thing.

In Jeff Booth’s book “The Price of Tomorrow,” he describes how technology is deflationary. If we had a sound money like Poilievre described, it would make sense that technological advancements and productivity gains would cause prices to drop.

With a more sound money that does not continually inflate like our current debt-based, broken money system, your purchasing power would not decline over time and we would enjoy the deflationary benefits of technology.

With deflation and a more sound monetary system, you could live a dignified life and afford a home on a smaller wage as prices naturally come down.

Critics of sound money will say that under the gold standard we saw booms and busts, and you can’t get out of an economic depression without inflating the money supply.

There is no easy answer here, and the solution is probably something in the middle, at least during a transitory phase. We need to slowly transition to a sound money system while also increasing financial literacy.

Critics of sound money systems like a gold-backed standard too often rely on a false dichotomy argument, where it has to be either continuous stimulus or global depression with nothing in the middle.

Something has to change — it’s clear that the debt-based, money-printing, stimulus-by-default system we’ve been operating on has seen continual expansion of the wealth gap. In fact, it is plausible to have a period of transition where you could help the bottom 50% out with a form of universal basic income, while you increase financial literacy and encourage saving in a hard money.

You could do this while eliminating a lot of excessive federal spending, and transitioning to a more sound monetary system over a period of five to 15 years, all while we enjoy the benefits of technology making our lives better!

Politicians, mainstream economists and central bankers are fighting the deflationary benefits of technology by arbitrarily targeting 2% inflation and continually increasing the supply of money via various methods like government deficit spending, commercial bank credit creation and central bank money printing.

Since these economists and bankers were claiming that QE and stimulus didn’t cause inflation, they were fear mongering about a “deflationary spiral,” trying to create the political will for the next round of money printing to keep their inflation experiment going… and, predictably, they overreacted and gave us an inflationary crisis instead of a deflationary one.

Governments Cause Inflation And Inflate Asset Bubbles With QE

Canada’s central bankers follow the consensus of the rest of the G20 countries, especially the U.S.

Like most G20 countries, the Canadian government cannot finance deficit spending without issuing debt.

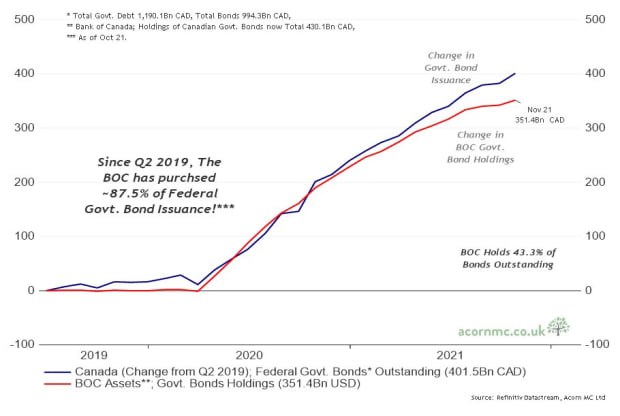

Since there was not sufficient demand to purchase the newly-issued debt (bonds), Trudeau and Freeland worked in lockstep with Bank of Canada Governor Tiff Macklem — essentially directing the Bank of Canada — to buy long-term debt from the government (via the banks) to artificially manipulate the rates as close to zero as they could get it. They call this QE.

Shockingly, beginning in 2019, the Bank of Canada has purchased an abnormally-high percentage of all Canadian government bonds issued, which has enabled the Trudeau government to ignore free market impulses and put the country into historic debt levels.

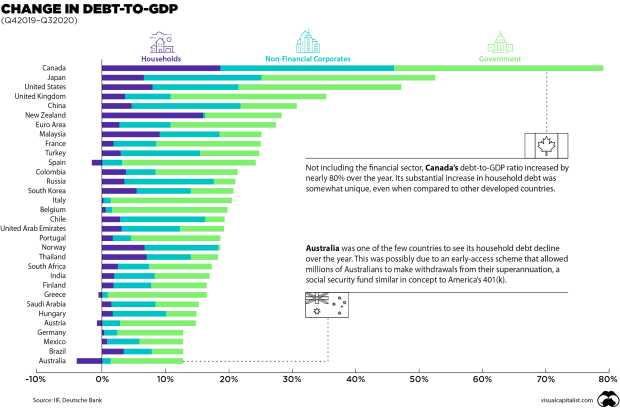

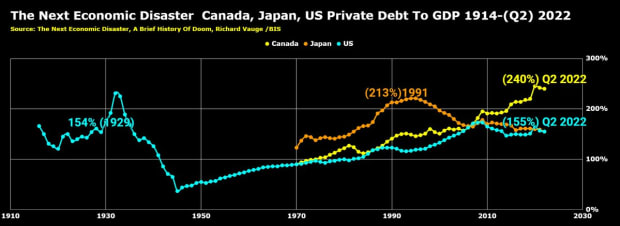

Canada’s public and private debt-to-GDP expanded much faster than any other G20 country at the start of 2020.

That trend continued until just recently, when our total debt-to-GDP began to look more like the peak of the U.S.’s debt-to-GDP ratio in the 1940s during World War II.

Remember: this includes public debt (federal and provincial government deficit spending and liabilities) and public debt (corporate and household debt).

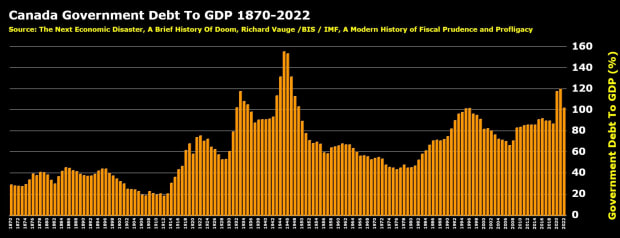

From Canadian macroeconomic forecaster Joseph Barbuto, aka Economic LongWave, here is what Canada’s historical debt-to-GDP looks like over the last century (we have to go back to the 1930s to see the last time our public debt-to GDP ratio was this high):

Part of the reasoning behind this massive deficit spending was that Freeland and Macklem were both blindsided by inflation, along with all of their G8 money master peers, fear mongering about deflation as recently as October 2020.

In August 2022, after the price of homes, investments and other desirable items had caught up to all of the newly-issued money and inflation soared to the highest it’s been in decades, Freeland, Macklem and the Bank of Canada were trying to control the narrative around inflation.

They released a statement claiming that they did not cause inflation by “printing money,” and shifted the blame using the “everyone else is doing it” defense while advising businesses not to increase wages in response to rising prices.

Jesse Berger, a Canadian author focused on monetary policy, commented, “Earlier this month the Bank of Canada blamed you for inflation and told you not to give raises despite awarding themselves $45 million in bonuses.”

He continued, “Where did they get the funds to buy bonds? They didn’t ‘print cash’ per se, they just used a ‘kind of central bank reserve’ thing. No physical notes means it’s not literally ‘printed cash.’ So it’s a figurative lie, not a technical one.”

This is how they try to confuse what they are doing with complicated terms like “quantitative easing” and obfuscate what money is by labeling the money they create during QE as “central bank reserves.”

However, in November 2022, Macklem testified that the Bank of Canada should have started tightening rates sooner and Government spending contributed to inflation.

What Is QE? Quantitative Easing, Demystified

Poilievre spoke at a rally about the effects of quantitative easing on the money supply, inflation and interest rates in Canada.

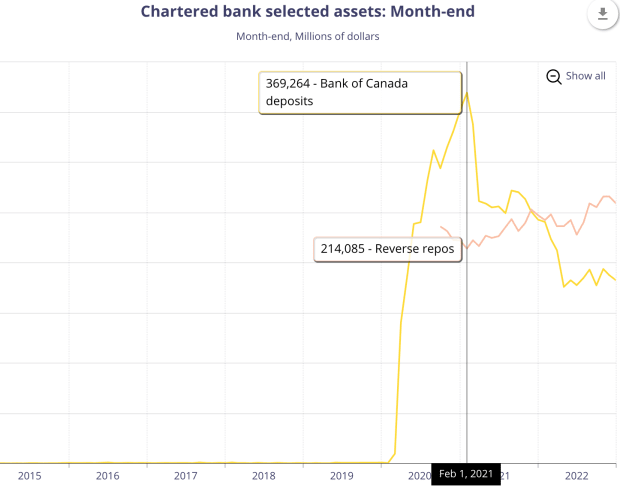

Cogently explaining how the central bank pays to buy the bonds from the government, he said, “Well, it deposits money in the financial institutions’ accounts held at the Bank of Canada. The deposits for these financial institutions skyrocketed to about $300 Billion from almost nothing within a couple of years.”

He continued, “Those deposits can be turned into hard paper cash. That is why the money supply went from $1.8 trillion to $2.3 trillion — half a trillion dollars, which is almost exactly what the deficit was — not a coincidence.

“The paper money — the stuff that’s printed — went from $90 billion to $124 billion. Both increased by approximately 27% in a few years.

“The money that’s still on deposit with the central bank has created a new problem. The central bank bought bonds with yields of 0.25% and paid for it with deposits on which it now has to pay 4.5% — in other words, they’re now losing money on the spread.

“For the first time in history, the Central Bank of Canada needs a bailout of $4 billion a year. That doesn’t take into consideration any additional losses that will happen if they eventually sell those bonds which are worth less now than when they bought them.”

“This has been very good for the very wealthy because in addition to arbitraging those transactions, this inflationary policy drove up asset prices,” Poilievre continued. “If you have a $10 million mansion and house prices go up by 50%, you’ve just made $5 million tax free. If you’re the new immigrant who doesn’t own any property, the purchasing power of your dollar in terms of real estate has just gone dramatically down.”

Poilievre punctuated his lesson on how QE creates wealth inequality by saying it is “a massive wealth transfer from the have-nots to the have-yachts.”

Quick Review So Far

At this point, l’d like to recap and add some more factors to the discussion so we can continue understanding why many banks are technically insolvent and starting to fail:

- Central bankers held interest rates too low and signaled to everyone, including the banks, that they will continue to keep rates low to avoid deflation, promoting the flawed logic of “inflation is transitory” and “deflation is bad.”

- Banks do not operate on a reserve system anymore — instead they continually create debt money through credit issuance and are encouraged to hold high-quality liquid assets, such as government bonds and mortgage-backed securities, to protect against bank runs in case everyone discovers there are not adequate reserves for everyone to get their money out.

- Governments inflated the money supply with massive stimulus and deficit spending. Central Banks enabled the massive deficit spending with QE.

- QE by itself did not directly add new money to the system, even though the central bank created the reserves from nothing — because banks used existing money (our deposits!) to buy the bonds which they sold to the central banks.

- The G7 made a difficult decision to drop a nuclear bomb on the financial system by sanctioning Russia, putting contagion pressure on European and other Western banks.

- Central banks started raising rates faster than they ever have before in history to combat inflation, deflating the bond bubble and causing banks to become insolvent.

As Poilievre mentioned in his rebuke of QE, central banks could realize losses if they are forced to sell bonds.

However, a fair rebuttal to this argument is that central banks don’t have to sell their bonds — they will likely hold them for years or decades to maturity and not realize any losses in dollar terms because they can create the dollars.

(This is why they claim that the bonds are “risk free.” While it’s true that they are risk free when denominated in the currency, they are not risk free when measured in purchasing power.)

Unlike central banks, regular banks are in a precarious position where they have to sell underwater bonds as depositors withdraw record amounts of money.

Due to this exodus from the banking system, they are no longer able to hide the problem with accounting tricks. The depositor runs are forcing banks to realize the massive losses that were hidden with held-to-maturity (HTM) accounting rather than fair-value accounting of their underwater bond portfolios.

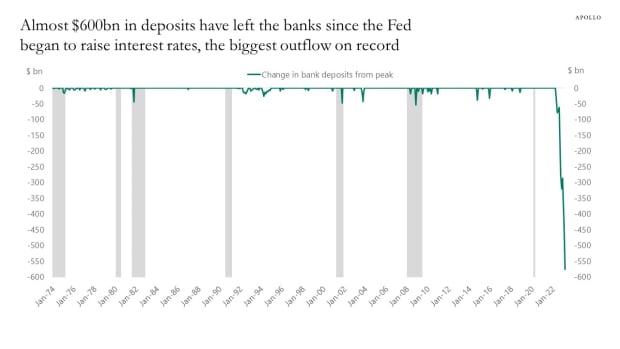

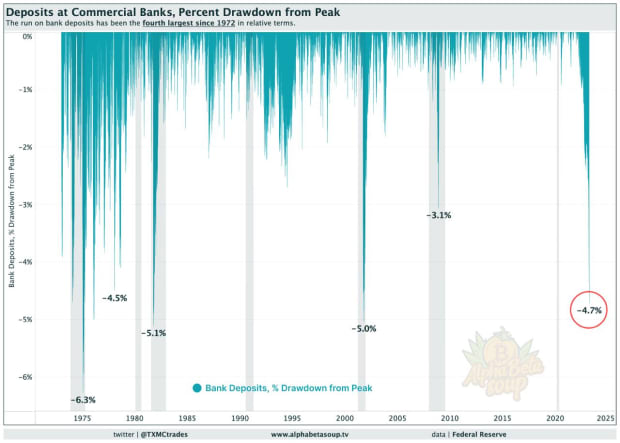

This accounting trick only worked as long as depositors didn’t withdraw their funds. Now that there are record withdrawals happening, as demonstrated in the chart below, it is exposing the insolvency and causing banks to fail.

Why Are People Withdrawing Their Money At Historic Rates?

There are two main reasons why depositors are withdrawing their money.

Firstly, as depositors lose confidence in their banks, it causes them to move their money to a bank that they trust more. Secondly, high interest rates are causing depositors to wire their money out of their accounts to seek higher yield in money market funds, bonds, guaranteed investment contracts (GICs) and certificates of deposit (CDs) and other investment vehicles.

Maybe you haven’t thought about how unfair this is, but many people are realizing that the banks and central banks are taking advantage of them.

Let’s say you’ve been depositing and saving money at a big bank, and the big bank gives you a savings rate of roughly 0%. The big bank took your money and bought government debt during QE and received central bank reserves which it parks at the central bank and now gets paid about 5%!

People are waking up to how unfair this is, and they are wiring their savings out of their banks and putting it into investments and alternative stores of value, like gold, real estate and bitcoin.

In an age of digital money, bank runs in the 2020s don’t look like they did in the 1920s. Instead of lineups around the corner, now we have digital bank runs.

In 2022, a record $600 billion in deposits were withdrawn from U.S. banks:

TXMC, a monetary historian and market analyst, has suggested that a more fair way to visualize the amount of withdrawals is by looking at the percent drawdown in bank deposits, which adjusts for the increase in the money supply over time:

Either way you choose to look at the data, there is a historically-significant amount of withdrawals happening from bank accounts.

Blaming COVID Is Inaccurate: Government Bonds Are Losing Value

The banks are backing only a fraction of deposits by holding some of their reserves in HQLAs like U.S. treasuries, which are supposed to be easily converted to dollars. (Colloquially, this is known as “money good.”)

U.S. treasuries are thought of as the safest collateral in the world. The U.S. bond market has historically been deeply liquid and U.S. bonds are considered to be the “world reserve asset” alongside the U.S. dollar as the “world reserve currency.”

However, the cracks started to appear in the foundation of the financial system in 2019, before the pandemic was used as an impetus to restart QE.

In 2019, the Federal Reserve tried to slowly raise interest rates and stopped doing QE.

Since we operate on a debt-based money system where our economies are addicted to stimulus, when the central bankers “took away the punch bowl” by stopping QE, and started to slowly raise rates, the interbank lending markets froze up. Overnight, bank-to-bank borrow rates massively shot up to more than 10%!

This liquidity freeze up is similar to what started the 2008 financial crisis, so the Federal Reserve immediately intervened in the interbank lending markets and started doing a stealth form of bank bailouts the year before anyone had even heard of COVID-19.

Many were speculating at this time, in 2019, that Credit Suisse or Deutsche Bank were functionally insolvent, and that they — and many other banks — would have failed much sooner had the central banks not intervened in 2019 and 2020 with massive bailouts in the interbank lending markets, the corporate bond markets and the U.S. treasuries market.

Since cracks have started to show in the U.S. treasuries and mortgage-backed securities (MBS) markets in 2019, 2020 and 2021 with no-bid auctions, rate volatility and growing illiquidity, the central banks are doing whatever they can to prevent banks from having to add sell pressure to the U.S. treasuries markets.

With record outflows from depositors, banks like Silicon Valley Bank and Credit Suisse were forced to start selling their bonds, realizing the losses on their underwater bond portfolios and going insolvent.

These issues in the banking system and bond markets were not caused by COVID-19, and the trend of bank failures is clearly not over as another large U.S. bank, First Republic Bank, has been taken over by the FDIC and sold to JPMorgan.

Added Pressures From Europe And Russian Sanctions

Almost precisely one year before Silvergate Bank failed in the U.S., kicking off a wave of bank failures, I wrote about how the Russia sanctions were a nuclear bomb that went off in the banking system and expected to see a wave of bank failures come in the wake of it.

Much like how two nuclear bombs ended World War II, capital-crushing central bank policy rate hikes and Russian sanctions were like two nuclear bombs dropped on the economy and the banking system. The shock wave took one year to make its way around the world, and now we’re dealing with the fallout.

European banks like Deutsche Bank and Credit Suisse were very intertwined with Russia, and tried to resist cutting ties with Russian business lines as this would inevitably lead to their failures, which would spread as contagion to the rest of the global banking system.

When you want to get an idea of the health of a bank, you can look at a few things, things such as:

- CET1

- LCR

- Share price

- Credit default swaps (CDS)

We already covered CET1 and LCR earlier, and a bank’s share price dropping is a pretty obvious sign that market participants have found something concerning, so let’s discuss credit default swaps.

CDS are a form of insurance against debt defaults and insolvency for large institutional traders and investors to hedge the risk of owning the debt of an entity. People watch the CDS market to get another signal of what sophisticated investors think the likelihood of an entity defaulting is.

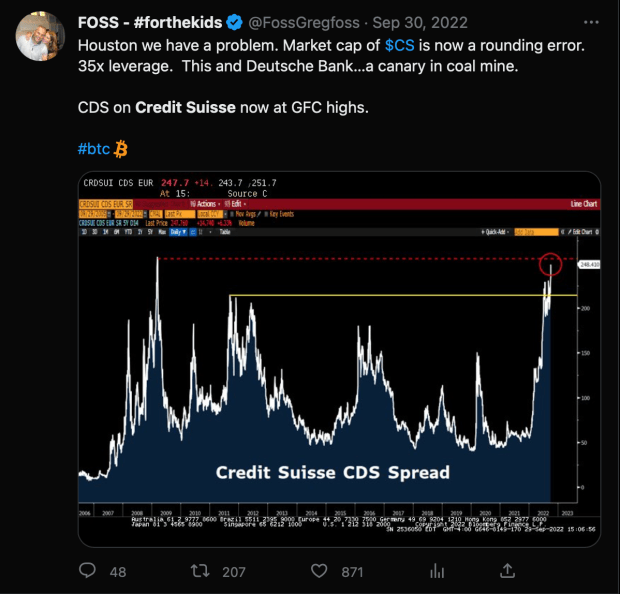

In July 2021 and again in September 2022, Canadian bond trader and 35-year risk manager Greg Foss publicly warned of the incredibly-alarming rise in the price of CDS insurance against Credit Suisse and Deutsche Bank:

Credit Suisse had exposure to some smaller funds that went insolvent in 2021, which restarted its troubles and speculations around its insolvency.

After the Russian sanctions and rate hikes added even more pressure and fear, Credit Suisse experienced an $88 billion bank run through the summer and fall of 2022.

Another $69 billion was withdrawn in Q1 2023 and fears around its insolvency grew, which the CDS market showed.

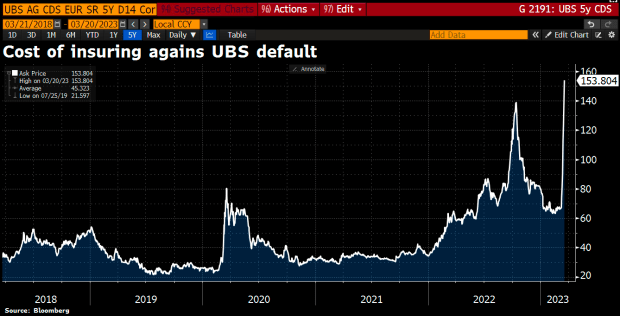

As the bank started liquidating its bonds at a loss, no longer able to hide its insolvency with held-to-maturity accounting, a forced takeover by UBS bank with a backstop from the Swiss government occurred.

Switzerland has a GDP of only $800 billion, so many are starting to worry about

the credibility of the Swiss national bank backstop, as well as the solvency of UBS. You can see this in the rising cost of insurance against a UBS default in the CDS market.

The risk did not go away when Credit Suisse failed, it transferred to UBS:

How Bad Is This Compared To Previous Bank Failures?

Three of the largest bank failures in U.S. history have just happened, Silicon Valley Bank at $209 billion, Signature Bank at $118 billion and First Republic Bank at $229 billion.

(For reference, the largest bank failure in U.S. history was Washington Mutual at $307 billion in 2008.)

Hundreds of U.S. banks would technically be insolvent if it weren’t for HTM accounting, in a similar position as the banks that have failed already. Time will tell if banks like Silicon Valley Bank and Silvergate were the riskiest banks or just the first banks to fail.

The failure of these large banks led to emergency action by the Federal Reserve, starting up a new round of bailouts and lending programs designed to prevent the banks from having to realize the losses on their U.S. treasuries.

Instead of having to sell their HQLA government bond portfolios and realizing losses to meet withdrawals, they can now borrow money from the Federal Reserve against their bond portfolios at the held-to-maturity value rather than the actual market value.

Essentially, central planners intervened with the free market pricing mechanism, rescuing banks once again by allowing them to mark up the value of their bond portfolios to their held-to-maturity values rather than just borrow freshly printed Fed money — allowing them to borrow even more money than what the bonds are worth.

Typically, banks avoid borrowing from the Fed via the discount window as there’s a stigma attached to the institutions who do so. Remember, the colloquial term is that the Fed is the “lender of last resort.”

Since it’s public who is borrowing from the Fed as a last resort, that’s interpreted as a sign of weakness by the market. But when there’s systemic risk in the system, the stigma of borrowing from the Fed seems to be removed.

Strangely, the Federal Reserve is actually charging banks a pretty high interest rate.

In this scenario, the Federal Reserve has gone from the lender of last resort to the loan shark of last resort for small- and medium-sized banks, paying about 5% for Bank Term Funding Program (BTFP) funding or borrowing at the Fed’s discount window.

They call this program BTFP, and I look at it like a living will for the U.S. banking system.

What The BTFP Does To Slow The Banking Crisis

The Fed’s BTFP does two things.

Firstly, it hopes to stop the banking crisis by giving banks more time to process withdrawals, stopping panic from spreading as customers return to a state of complacency with their deposits.

It is buying time. The longer this draws out, the more they can control the narrative.

Secondly, if that fails and this really is the resolution of the 2008 crisis where we see sustained bank runs and systemic bank insolvencies, the BTFP helps reduce the pressure on the FDIC if it has to resolve hundreds of small and medium bank failures.

As we’ve learned so far, there is not enough demand in the free market to buy the bonds that the government is trying to sell, so the central bank has to buy the bonds to fund government deficit spending and QE.

There is upwards of $2 trillion in bonds held by hundreds of small- and medium-sized banks.

If these banks have to sell these bonds into the market, that will freeze up the bond market, which might cause a loss of confidence in the money itself, which is much worse than a loss of confidence in banks.

The Fed’s BTFP allows them to create up to $2 trillion and lend it to these banks, taking their underwater bonds off the market and putting some 500 small- and medium-sized U.S. banks into debt to the Fed.

If these banks fail, the Federal Reserve can absorb the bond collateral onto its balance sheet without it looking like another round of QE and bailouts as the banks have become debtors to the Fed.

These money-printing, bank-lending schemes are all about buying time and stopping fear from spreading in both the banking system and the bond market themselves.

Is This A Widespread Banking Crisis?

If enough customers try to withdraw their money from banks, the banks will go insolvent… because not only are the dollars printed from nothing, but the banks do not even have the “dollars” anymore.

In fact, the money in your bank account is not even “your money.” It’s actually a liability on the bank’s balance sheet. This is why bank bail-in provisions were written into law post-GFC.

If they can not prevent the fear from spreading and we see a systemic failure, banks can legally do bail-ins and haircuts above the CDIC/FDIC limits, like we saw in Greece and Cyprus a decade ago.

The FDIC and the Fed knew the banks were in trouble last year. They started holding meetings and trying to come up with rule changes to figure out how to resolve large bank failures.

They know FDIC insurance is a fairy tale designed to keep depositors placated and that if large banks start to fail, the FDIC fund is laughably undercapitalized to resolve that situation.

They discussed doing haircuts and bank bail-ins, as well as disclosing information on the true risks in the banking system to the public in advance of a systemic event.

Some recent comments from FDIC regulators on bank bail-ins from November 2022:

“It’s important that people understand they can be bailed-in. You don’t want a huge run on the institutions, but there are going to be (runs) and it could be an early warning signal to the FDIC and the primary regulators.

“…and if there’s significant long-term debt, you can contemplate a bail-in-type exit for these institutions where you’re turning the institution over to its creditors.”

There does not seem to be the political will to allow bail-ins to happen yet.

As we saw just a couple of months after this FDIC meeting, when banks actually started to fail, the Silicon Valley billionaires were bailed out instantly and all deposits were guaranteed.

The $250,000 FDIC limit was essentially thrown out the window immediately.

While the legal framework is in place, bail-ins seem to be a last resort tool at the bottom of the toolbox. You can think of bail-ins like lockdowns. They will only go with that option when they are about to completely lose control. In February 2020, the idea of schools and public buildings being shut down and everyone being forced to stay at home was thought to be hyperbolic and ridiculous.

FDIC/CDIC Unable To Handle The Failures Of Large Banks

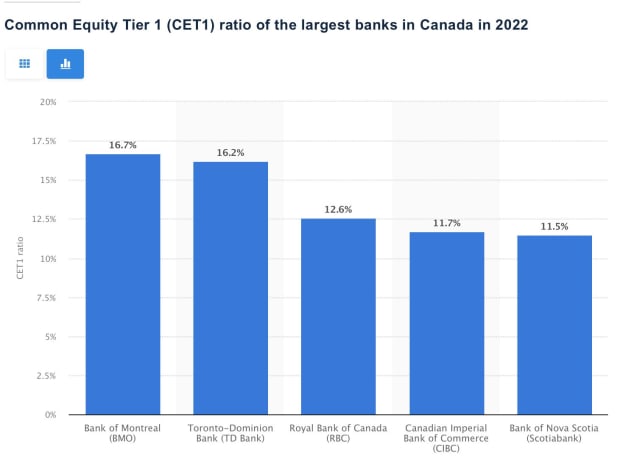

In fact, when you look at the CET1 ratios of Canadian banks, it does not look great.

Silicon Valley Bank failed with a CET1 ratio of 14%, and Credit Suisse failed with a CET1 ratio of 15%, which is better than the Royal Bank of Canada (RBC), Canadian Imperial Bank of Commerce (CBIC) or Scotiabank, which are all under 13%:

The risk was not flushed out of the system after the 2008 financial crisis.

They socialized the losses and privatized the gains with bailouts and stimulus, increasing wealth inequality, damaging the purchasing power of your savings and kicking the can down the road as far as they could.

The can is at our feet again. We are at a fork in the road.

There’s not enough capital buffer in the banking system to absorb the massive losses in these bond markets.

Preston Pysh, host of “The Investors Podcast,” recently tweeted:

“The total capital buffer in the US banking system is $2.2 trillion, while unrealized losses are between $1.7 and $2 trillion. If banks had to liquidate their bond and loan portfolios, they’d lose 77-91% of their capital cushion, highlighting the fragility of most banks. 186 US banks are in distress.”

The idea that CDIC/FDIC insurance can cover the losses from a systemic failure is a fantasy.

The FDIC couldn’t handle even the first bank failure in 2023 and had to tag in the U.S. Treasury and the Federal Reserve to backstop depositors, as 97% of the deposits of that bank were those millionaires and billionaires, evidenced by the fact that they were above the $250,000 deposit insurance limit.

They decided to rescue all depositors instead of applying haircuts/bail-ins because, understandably, they felt like it would lead to systemwide panic and full-on

bank run, cascading to an unstoppable banking crisis like we saw in the 1920s, rather than the one in 2008.

There was also a real, legitimate issue of many Silicon Valley companies being unable to meet payrolls on the following Monday, and what that would do to the economy, which is overly dependent on tech companies.

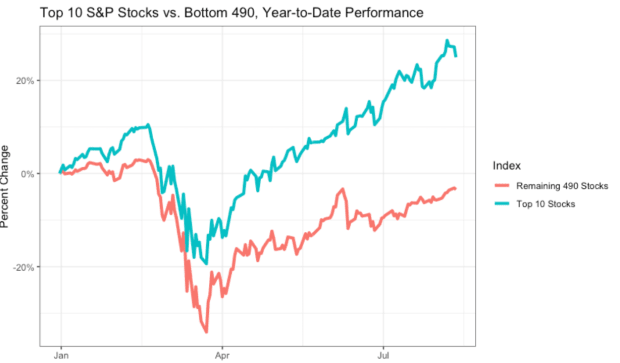

Tech companies drive stock market performance: If you look at the stock performance of the top five or 10 tech companies, and then look at the other 490 companies in the S&P 500, the economic outlook would look a lot worse:

Imagine what would happen to the U.S. stock market, which has been artificially inflated to record high prices via money printing and low interest rates, if Facebook, Google, Microsoft and all of the non-profitable-but-public tech companies lost tens of billions of dollars to bail-ins and couldn’t meet payroll.

The choices facing the FDIC, U.S. Treasury and Federal Reserve are not easy ones. There are decades of policy mistakes and bipartisan political blundering that brought us here.

So, is the $250,000 FDIC limit just a fantasy if all deposits of the Silicon Valley elite were backstopped? Did the government just tell us that it will socialize all money in the banking

system with this action, or is it just going to pick winners and losers as more banks start to fail, and eventually the bail-ins start?

Foss has pointed out that, even with all of the bailouts, emergency lending programs and confidence games that the Fed, U.S. Treasury and FDIC are playing, soon the interest rate risk might spillover to credit risk, which will be even worse for banks.

The FDIC was formed in the 1930s when the United States was still on a somewhat-sound monetary standard; it was a way to provide confidence to depositors in the U.S. banking system who had lost trust in the banks.

Today, the FDIC fund only has around $100 billion, which is lower than the mandated amount. Buffet has more money than the FDIC fund does.

As the monetary system transitioned from sound money to credit money, and the supply of money expanded rapidly, the idea of FDIC insurance is more of an illusion — another confidence game.

We are supposed to believe that this FDIC insurance is financed by fees that banks pay on deposits, however, as we’ve seen with the recent bank failures and in previous periods of financial crisis — such as the savings and loan crisis in the ’80s and ’90s and during the GFC in 2008 and 2009 — the FDIC is too big to fail and it will also get bailed out.

They will do whatever they have to in order to prevent people from peeking behind the money curtain to see how things really operate.

So, what does all of this mean?

One thing is for certain, all of this central planning and interference in the free market to prevent the risk from flushing out of the system has a cost:

Wealth inequality is going to keep rising and your money is going to continue to lose purchasing power over time, probably at an accelerated rate.

I believe there are really only three ways that this can be resolved.

One: No Can Kick, Leading To Deflation And Falling Prices

Why would we see this? Well, the G8 central bankers are all trying to fight inflation at the same time as they are trying to prevent a banking sector meltdown, which requires them to keep raising rates and not doing any more blatant QE (although, in Canada, we raised first and have since put a pause on raising rates.)

Another reason why this scenario is plausible is the looming debt ceiling. There’s a statutory cap on the amount of debt the U.S. government can have, and it will need to be legally raised again before another massive round of stimulus can happen.

In 1939, U.S. Congress passed the initial “Public Debt Act” which established limits on aggregate U.S. debt levels.

The debt ceiling has been raised 98 times since, although sometimes this becomes a partisan battle if an opposing party controls the presidency, house or senate.

In the long arc of history, it really doesn’t matter who’s in power; they eventually raise the debt ceiling and print.

However, this debt-ceiling deadlock can cause problems in the short term, and we’re potentially facing that scenario now where the Republican-controlled Senate does not want to allow the Democratic president to issue more debt coming up to an election year.

This is deflationary because it effectively shrinks the money supply and would lead to a continuing decline in bonds and stocks.

In the “no can kick” scenario, we would see more banks fail and we could potentially even see the extreme conditions required to force bail-ins where depositors start to take haircuts.

Real estate would crash in this deflationary spiral, erasing the “phantom wealth” that most people feel when they borrow against their retirement accounts and real estate portfolios that have grown rapidly in value during the bubble.

This could lead to governments being unable to run massive deficits, as there would be no net-new buyers for bonds and confidence would be lost in government treasuries as the safest place to protect wealth.

Two: Can Kicked Too Hard, Leading To Hyperinflation

This scenario is the least likely to happen in the U.S. or Canada. It’s extremely unlikely yet worth discussing as it would require massive policy errors.

In this scenario, we see some exogenous event such as a once-in-a-generation pandemic, or a coronal mass ejection (CME) similar to the Carrington Event, perhaps a nuclear war or an unstoppable rogue AI internet virus, which causes an acceleration of existing risks in the system.

Some people call these hard-to-predict financial shocks “black swan” events.

If we get a significant black swan event that accelerates the current banking crisis, we could see a sudden collapse of hundreds of banks as global stock markets rapidly crash and bond markets lock up, similarly to what we saw in 2008 or in March 2020.

A real estate market correction could also accelerate to a crash, causing public outcry for policymakers and central bankers to once again lower interest rates and rescue the economy.

Emergency measures would be taken, similar to what we saw in the aftermath of COVID-19, however, this time we would likely see 1930s-style price fixing, capital controls and much more massive bailouts by the government and central banks.

Only if they print obscene amounts of money in response to the crisis do we start to enter hyperinflation territory.

Hyperinflation is defined as rapid monetary inflation causing prices to increase at 50% month over month. Oftentimes when people use the term hyperinflation, they don’t actually realize what they are saying, and they can sound hyperbolic to someone who understands the dictionary definition of the word.

Policymakers would have to make all the wrong choices and not have learned anything from history to cause a hyperinflationary collapse.

It’s a very unlikely scenario.

Three: Can Kicked, Status Quo With Inflation

This is the most likely scenario. There’s no political will to see deposits start taking haircuts, and nobody seems to want to pull the lever to be responsible for a recession.

With a status-quo can kick after the debt ceiling is raised, we get continued waves of higher inflation with interest rates held lower.

The bond markets continue getting propped up by the central banks as QE restarts and the Fed’s balance sheet expands by upwards of $10 trillion to $20 trillion.

This is where we see Ponzi finance starting to become more obvious to most people as the share of the U.S.’s debt owned by the Fed crosses 50%.

I’m not sure whether it will be able to fight the free market forces of higher interest rates, but it will try to artificially drop rates as close to zero as it can get it in order to finance the massive and growing debt of the public and private sectors as inflation rises and we continue in a higher inflation environment.

This creates another crisis in about 10 years.

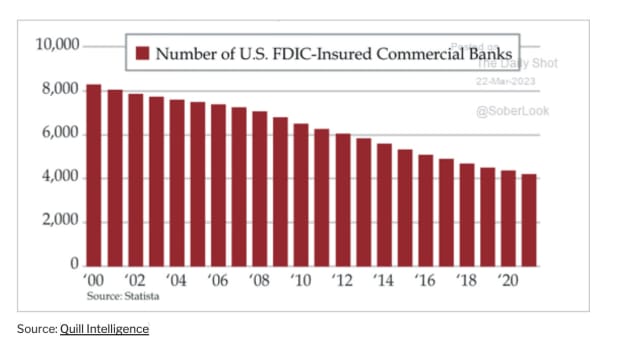

Since banks are insolvent in any of these scenarios, we may still see hundreds of bank failures which will lead to further centralization of the banking system.

We will likely see the continued trend of banking Canadianization in the U.S., where 500 to 1,000 small and medium banks fail and get absorbed by larger banks.

The FDIC cannot resolve this many banks, which is why the Fed is acting as the loan shark of last resort.

The Fed absorbs up to $2 trillion of treasuries from the insolvent banks as they default on their loans from the Fed.

How Do You Protect Yourself?

Diversification out of dollar savings and into more scarce assets is wise. Global index funds, gold, farm land, bitcoin, etc. are all attractive options to protect and grow your purchasing power.

The response to the crisis is likely going to be more of the same: printing money and bailouts.

The purchasing power of the dollar will continue to decline against scarce assets like gold and bitcoin.

Most people reading this will not have enough money to invest into something like farmland, and while dollar-cost averaging into index funds has historically been a great bet, it has the same counterparty risks to a banking system collapse and capital controls as keeping money in the bank does.

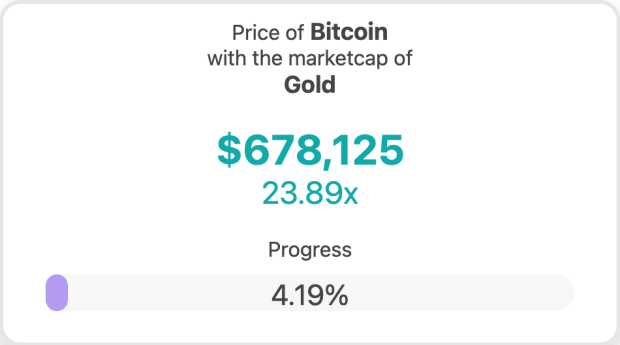

Compared to gold, bitcoin is the fastest horse in the race and it is likely to increase in purchasing power faster than gold until it gets to gold parity, likely within 10 years.

For reference, the price of 1 bitcoin would have to increase by about 24 times to $678,125 per bitcoin in order for it to have the same market cap as gold.

As Bitcoin gains relevance as a post-trust, world-reserve asset and digital currency for the internet, it could rise in value significantly.

On Bitcoin’s Volatility

If you’re a wealthy investor who is nervous about bitcoin’s historical volatility, even having a conservative allocation, like 5% of your net worth, to bitcoin as an insurance plan is still a wise strategy.

If your bitcoin drops significantly in value, or if you lose conviction and sell it in a drawdown, it won’t materially affect your life. However, if bitcoin does what many of us expect it will do over the next five to eight years, a 5% allocation to bitcoin could provide outsized returns.

If you’re the average Canadian who doesn’t have a significant net worth and lives paycheck to paycheck, saving a larger portion of every check in bitcoin with a five-to-10-year timeframe could change your life significantly. It did mine.

As a bootstrapped internet entrepreneur with no investing experience, I learned about money, the banking system and diversified investment strategies over the last 15 years managing my own wealth.

I started with a small allocation to bitcoin in 2011, and even though I’ve made many mistakes along the way during my school-of-hard-knocks education, the small bitcoin allocation has become the majority of my net worth.

I still hold other assets like gold, index funds, real estate and cash. I’ve held bitcoin through many volatile drops of 50% to 80% and I’m still buying bitcoin today with free cashflow.

Always expect the price of bitcoin to drop by at least 50% from where you bought it — volatility is part of bitcoin’s story as it bootstraps its way to become a global store of value. It’s imperative that you think about bitcoin as a long-term savings play, not a trade.

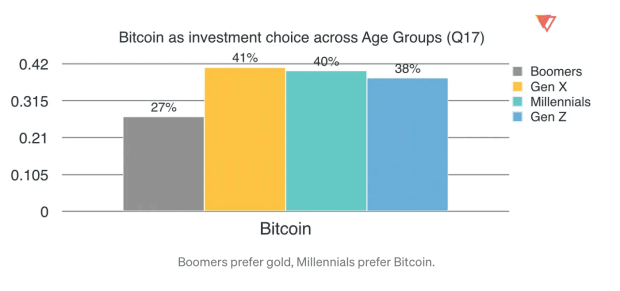

There is a $60 trillion wealth transfer coming from the silent generation and boomers to the younger generations. Gen X, millennials and Gen Z all prefer bitcoin over stocks, gold and cash:

Bitcoin has a credibly-scarce, disinflationary supply cap of 21 million, enforced by math, auditable by anyone and resistant to change by central planners, insiders or governments.

With an ever-increasing demand for BTC by younger, digital-native generations in their high-earning years, who will soon see a massive wealth transfer, the growth outlook for bitcoin is likely to only keep rising.

Also, it’s worth noting that bitcoin buyers typically have very high conviction. You can see in the data that the majority of bitcoin holders understand what they are buying, and they are willing to hold and even buy more through large drawdowns.

When the price of bitcoin peaked in 2021 and went through a bear market in 2022, dropping more than 70% from the high — the long-term holders actually increased their positions:

This is because bitcoin savers use a strategy known as dollar-cost averaging (DCAing). Bitcoin educators and influencers typically advocate a DCA strategy to avoid the follies of trying to time the market and become a trader.

Saving trumps trading in 90% of cases.

‘Should I Buy Bitcoin Or One Of The Other Cryptos?’

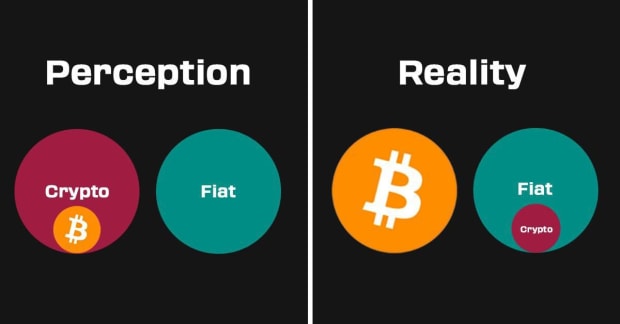

A common misconception about Bitcoin is that it is the same as “crypto.”

If I were to stress anything that you could take away from this, it’s that Bitcoin is not the same as crypto.

Most people would do well if they just ignored crypto and learned as much as they could about Bitcoin.

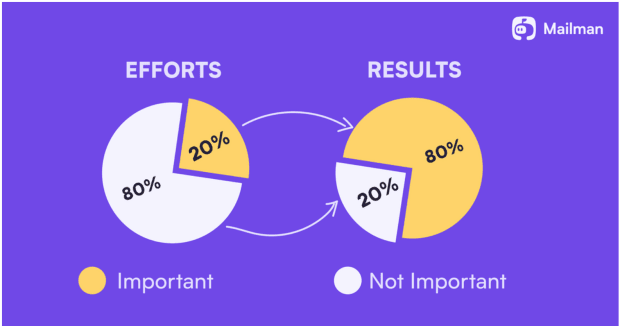

The Pareto principle, also known as “the 80/20 rule,” applies to Bitcoin. My advice to most of my friends and family member who ask me about other coins to buy is this:

You will achieve 80% of the results of active crypto traders with 20% of the effort if you simply save in and learn about BTC, ignore crypto and hold your BTC for 10 years.

At this point, most of the over 1 million crypto tokens are actually some variation of a Ponzi scheme, and many of them have been exploding over the last two years because they have no value aside from greater fool theory.

Not all of them are Ponzis. Some of them are just pump-and-dump meme investments, risky bets or even would-be “next bitcoin” competitors. A small percentage of them might have some legitimate value into the future.

Perhaps you’ve seen the top-25 or -50 crypto tokens and thought you should buy ETH, BNB or XRP to diversify into “crypto” as a whole rather than just simply save in bitcoin.

In this case, I strongly advise you to remember the Pareto principle and learn more about Bitcoin. You should do the work to understand why Bitcoin is valuable before you try to understand any of the cryptocurrency tickers.

In the significant majority of cases, whether it’s Ethereum, Solana, Dogecoin or an NFT from your favorite influencer, buying a crypto token is more like VC investing, buying penny stocks, forex trading, gambling or other forms of speculation.

Bitcoin is saving. Crypto is speculation.

Speculators can make money, but unless you want to be glued to charts, consuming crypto content for 80 hours a week while also learning how to be a professional portfolio and risk manager, you probably won’t come out ahead.

If you wouldn’t find yourself on r/wallstreetbets looking for the next YOLO bet on a meme stock, then don’t bother learning about Ethereum, DeFi, Web3, NFTs or “degen” crypto trading schemes.

If you would find yourself on r/wallstreetbets looking for the next get-rich-quick bet… do yourself a favor and do not drink the crypto kool aid.

There is no such thing as “the next Bitcoin.” Bitcoin is the next Bitcoin.

The Reality Of Trying To Outperform Bitcoin With Altcoins

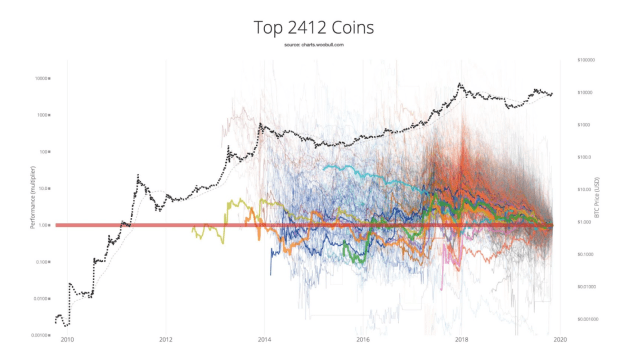

The majority of crypto traders will never get back to their BTC high watermark. The only way to beat Bitcoin long term is:

- Either give your money to, or be, an exceptional professional trader with clearly defined trading rules and execute your trading rules emotionlessly. The majority of traders lose.

- Get lucky and get out. If someone was lucky enough to buy a meme coin that rose 100 times in its value in a bubble, they likely will go back into the casino and give the majority of it back in the bear market.

- Be an insider. Most successful people in crypto have gone out on the moral risk curve, and exploited their reputations and insider access. They get paid to promote coins, launch their own coins or get into presales. All of these strategies allow insiders to trade their reputations for profits, getting coins for free (or extremely cheap) in order to dump them on retail at elevated prices.

Even most insiders and venture capitalists won’t get this right as, oftentimes, they also drink the kool aid, stay in the casino for too long and, over a long enough time frame, they become bagholders as well.

Of course you will see people cherry pick outlier coins or timeframes and say things like, “If you bought and held X coin in Y time frame, you would have out performed bitcoin.”

However, these people always leave out the very relevant truth that crypto investors don’t just buy and hold — they deploy into (and incur significant losses in) the mostly fraudulent markets of the Ethereum and crypto Web3/DeFi ecosystem.

To recap, there are two schools of advice givers you’ll come across in “crypto”:

- Bitcoiners. They advocate a simple buy and hold strategy to save in bitcoin over long time frames, like I’m advocating for right now.

- Crypto investors. They advocate for going out on the risk curve, spreading your bets and allocating to the meat grinder of rug pulls, yield schemes, exploits, gas wars, front running, sandwich attacks and exchange hacks.

A buy-and-hold-bitcoin savings strategy is the best for the majority of people as BTC outperforms the overwhelming majority of crypto coins over long time frames.

Advice For Bitcoin Haters

If you’re one of those people who are against Bitcoin because it’s digital, or for some other reason, then it’s going to be a rough ride for you unless you protect yourself properly with other forms of scarce assets.

Simply pulling cash out of the bank is not going to solve the problem because your cash is still subject to the same debasement as digital money in the bank.

Having healthy skepticism around Bitcoin is important — but it’s imperative that you do the work. Don’t just write it off because you have some misconceptions about it, or because you think you missed the boat.

Everyone should seek to learn from ethical Bitcoin educators, not crypto traders or blockchain digital snake oil salesmen.

Learn how to use Bitcoin as a shield against continued inflation of the money supply which debases your savings and erodes your purchasing power.

Here are my favorite resources to recommend you learn more about Bitcoin:

- Preston Pysh’s ”Bitcoin Fundamentals” podcast for bitcoin and financial market content

- Guy Swann’s Bitcoin Audible website where he reads the best Bitcoin articles

- Michael Saylor’s Hope.com for video interviews and articles

- Matthew Kratter’s Bitcoin University for bitcoin and investing educational videos

- BTCSessions’ YouTube channel for Bitcoin walkthroughs and tutorials

This is a guest post by Brad Mills. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

9 May 2023 12:00