The Future Of Energy: Bitcoin Mining

“Time-series analysis (Stern, 1993, 2000) shows that energy is needed in addition to capital and labor to explain the growth of GDP. But mainstream economics research has tended to downplay the importance of energy in economic growth. The principal models used to explain the growth process (e.g. Aghion and Howitt, 2009) do not include energy as a factor of production.”

– The Role of Energy in the Industrial Revolution and Modern Economic Growth, Stern and Kander (2012)

If energy is so important to any and every economy, why is it so aggressively avoided in research and discussion? Going further, why such heavy over politicization and division in the industry? Discard the tribalism in energy as nothing more than noise. It’s nonsensical down to its very core. We need as much energy being generated as possible in a way that doesn’t break an economy, and that can allow us to keep the wheels of society turning. How do we achieve such a lofty goal?

Direct monetization of energy generation.

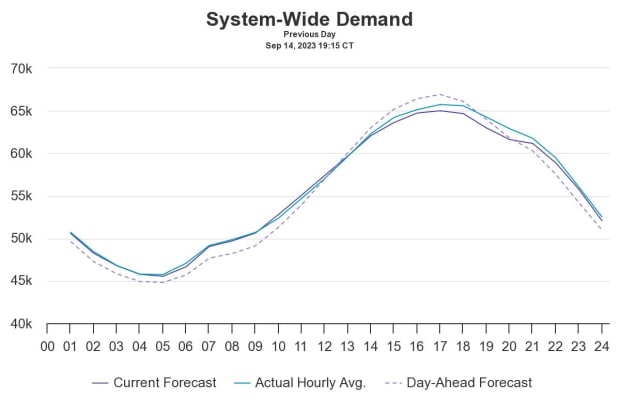

One issue: demand for power is volatile. It does not remain consistent throughout the day, let alone throughout the year. This volatility also bleeds into the varying forms of energy for economies that experience seasonal climate volatility or may be restricted in access to diverse sources.

Is there a way for us to smooth-out this demand volatility so that energy producers can maintain a consistent run-rate while still being capable of providing reliable power to societal fluctuations?

The Future of Energy

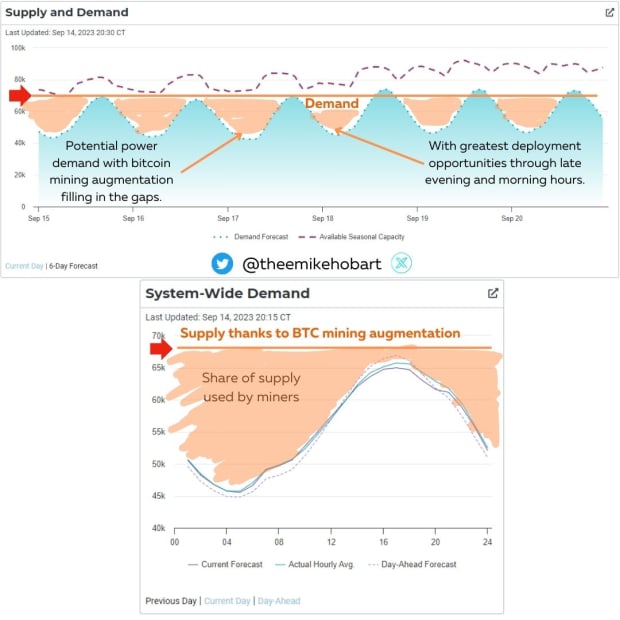

The answer is yes. This is achievable through bitcoin mining. We can use bitcoin mining to squelch the fraternal squabbles between all of the energy generators. All are free to compete for hashrate and seek that fabled next bitcoin subsidy distribution, so long as they agree to redirect power to the grid in society’s moments of need (which has been shown to be effective in multiple events and scenarios on Texas’ ERCOT system as well as in Georgia). The greater the power generating capacity of the operation, the more that they can afford to give society what it needs and still be capable of capturing revenue via bitcoin mining. The best part is, that bitcoin doesn’t care where the energy is coming from or being sourced; it wants it all.

We can now justify the rapid expansion of energy generation and distribution infrastructure by providing perpetual and highly competitive demand for that energy. Demand that is both buyer of first resort and last. This demand can be sourced through the cheapest energy resources, or through expanding current operations to provide greater output and maximize efficiency. All strategies are viable with this approach. Providing a responsive demand to the grid that can smoothen out the total demand curve is revolutionary.

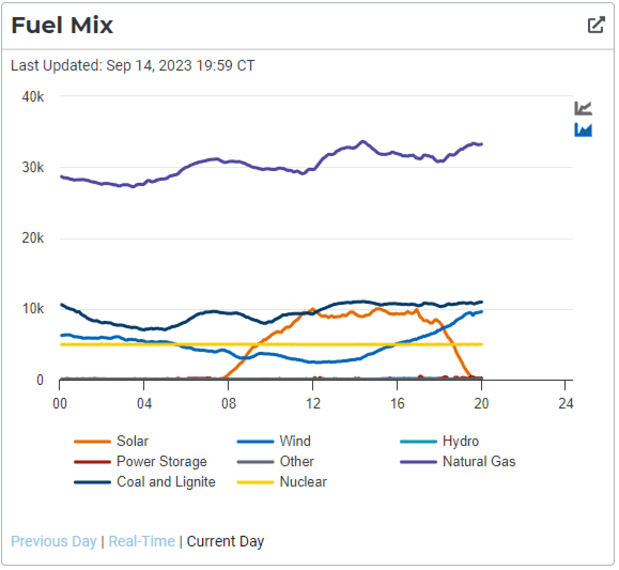

A well balanced system would have overall demand looking as consistent and flat as that line representing nuclear power supply above (yellow). But when you have natural demand ebbing and flowing (as seen in Figures 7 & 9) you need a flexible demand source that can fill in the gap between. You need a load that can shut off when societal demand surpasses forecasts, but provides such a benefit through both operational improvements and revenues that their product is readily sought after when circumstantial demands are satisfied, that they can be brought back online as soon as possible.

That, ladies and gentlemen, is what the bitcoin miners down in ERCOT and Georgia are doing. They are filling the gaps. What this is also doing is providing an incentive for energy generators to produce as much as possible. Meaning there is now a justification to build out operations that are capable of producing far more energy than is required now (but can be of use in the future).

Slippery Orange Coin

What happens to demand when the supply of electrons does not make production of the commodity easier. Where such an asset only continues to gobble-up as much energy as is thrown at it, not like gold, not like oil. These are two commodities that result in natural market forces bringing an end to high prices by justifying increased production during high prices and decreased production during low prices.

That is the beauty of the difficulty adjustment in bitcoin mining. When more power gets dedicated to the network, and blocks begin to get completed too rapidly, the network ratchets up the difficulty (and vice versa when blocks are coming in too slowly). There is no over production and over saturation of supply due to high prices.

Meanwhile mining pools allow for bitcoin miners to work together to earn the bitcoin subsidy. When such an outcome occurs the mining pool distributes earnings to the pool participants according to how much effort was dedicated as a percentage of the pool total (a fair collaborative system). Resulting in a far more consistent stream of income than if these miners were working alone.

Conclusion

All energy generators stand to benefit from deploying datacenters full of ASIC miners to take advantage of the perpetual demand afforded the bitcoin mining network. Furthermore the highly competitive industry is providing visceral demand for improvements in chip efficiency as well as the sourcing of not only the cheapest energy, but the most abundant capacity that is not being effectively utilized. Which is why energy producers and utilities are doing just that; using bitcoin mining to maximize efficiencies and improve operations, while earning an extra line of revenue.

The very foundations of energy are being retooled. The tribalism within energy will die away as all producers aim their sights at the great orange future cresting over the horizon. And they’re all positioned to make a lot of money for it.

This is a guest post by Mike Hobart. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

27 September 2023 14:12