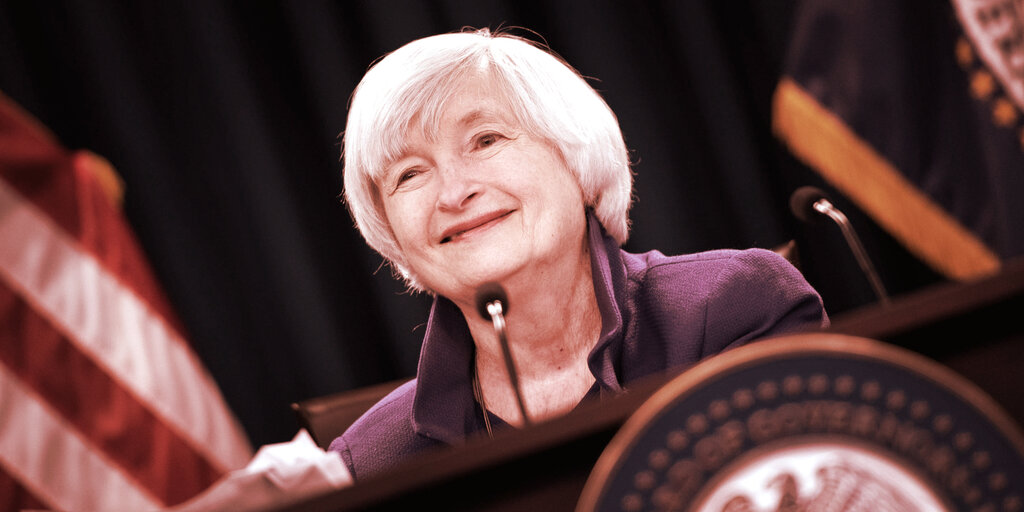

Yellen’s Treasury Behind Anti-Crypto Tax Provision in Senate Bill: Report

A debate in the U.S. Senate over taxing the crypto industry changed course suddenly on Thursday—and now it appears that U.S. Treasury Janet Yellen is the reason why.

According to the Washington Post, Yellen approached key lawmakers with concerns over a proposed amendment that would have exempted miners, validators, and other parts of the industry from new tax-reporting requirements.

“Treasury Secretary Janet L. Yellen spoke with lawmakers Thursday to raise objections to the effort led by Senate Finance Committee Chairman Ron Wyden (D-Ore.) and two Republican senators to weaken the legislation’s proposed cryptocurrency overhauls, according to two people who spoke on the condition of anonymity to share details of private conversations,” reported the Post.

Yellen’s reported involvement is significant because she is one of the most senior officials in the U.S. government, and because her agency, the Treasury Department tried, tried to impose onerous tax restrictions on the crypto industry in December. That effort fell short, however, amid pushback from the industry and as a result of staff turnover in the waning days of the Trump Administration.

According to Jake Chervinsky, general counsel for DeFi company Compound and well-known crypto lawyer, Yellen has elected to pursue the efforts of the previous administration. On Twitter, he stated that a bill currently being debated in the U.S. Senate provides “strategic cover to get jurisdiction over non-custodial market actors”—and could allow a way for Treasury to accomplish what it failed to do through regulations in December.

This isn't what I hear. Word is it comes from Treasury. They don't like what we're building & they're using the infra bill as strategic cover to get jurisdiction over non-custodial market actors, which they wanted but failed to get via FinCEN's proposed rule during transition.

— Jake Chervinsky (@jchervinsky) August 6, 2021

The bill in question proposes to spend $1 trillion to upgrade U.S. infrastructure, but contains a provision on taxing the crypto industry as part of a means to pay for that. Originally, the law would have defined nearly every player in the industry—from wallet providers to miners—as a “broker” subject to reporting tax obligations of their customers.

What that means is that miners would effectively be required to file 1099 forms on behalf of the users whose transactions they validate—and those users would likewise be required to file such forms as well. This would create what the EFF terms as a new “surveillance requirement” for crypto companies, as the names, addresses, and transactions of these users would need to be collected and reported to the IRS.

After critics pointed out this would have been onerous or even impossible for many crypto companies, some Senators proposed to exempt miners and others from the “broker” requirement.

That proposal was poised to sail forward until other Senators produced a counter-proposal that would have limited the exemption only to proof-of-work projects—such as Bitcoin—an arrangement that appears to have been pushed by Yellen. Critics argue that the counter-proposal still leaves proof-of-stake networks, such as Solana and the forthcoming Ethereum 2.0 blockchain, in the crosshairs. The matter is still before the U.S. Senate and a final vote is expected on Saturday.

Before becoming Treasury Secretary, Yellen held the post of Chair of the Federal Reserve. During her tenure there, she became the subject of one of the most famous moments in crypto history when an activist posed behind her during a hearing and help up a sign saying “Buy Bitcoin.”

6 August 2021 21:06